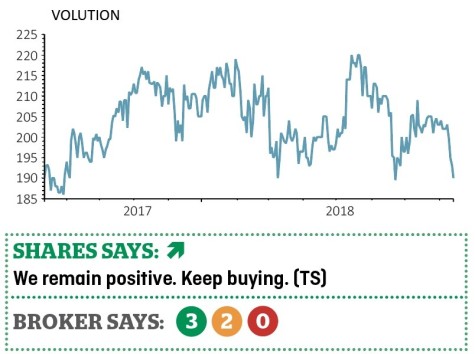

Volution (FAN) 191p

Loss to date: 4.5%

A year-end trading update on 10 August did not prove the positive catalyst for Volution’s (FAN) shares that we hoped it might be.

The company, which designs, assembles and markets ventilation fans, systems and ducting for domestic and commercial buildings, warned the market it had incurred extra costs due to delays in getting its new factory in Reading up and running.

The scale of these costs is not going to be spelled out in full until it publishes results for the year to 31 July 2018 on 11 October.

Apart from this negative news, trading has been robust. Revenue growth of 11% looks impressive and although a large proportion of this was attributed to M&A, organic growth was only just short of the typical 3% to 5% level.

Liberum analyst Charlie Campbell says: ‘Management has expressed optimism for 2019, which we think is justified by the contribution to come from the recent acquisitions, price rises from September in the UK and new product launches which should deliver improved momentum in UK (especially the public sector), Central Europe and New Zealand.

‘Clearly this optimism requires the factory move to be completed successfully but we think that the worst is now past.’

‹ Previous2018-08-16Next ›

magazine

magazine