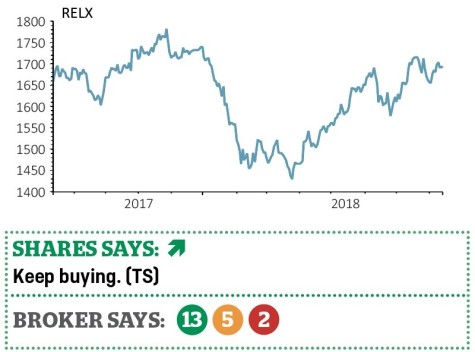

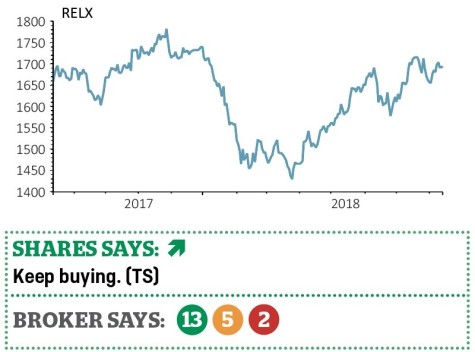

RELX (REL) £16.99

Gain to date: 13.3%

Amid the flood of first half results in late July and early August we neglected to update on our positive call on publisher RELX (REL).

Its interim results on 25 July were reassuring on the investment case, addressing fears over pricing disputes with universities in Germany and Sweden.

Its Elsevier division, which publishes academic journals, posted a 3% increase in revenue despite being at loggerheads with institutions in both countries.

This backs up research ahead of the results from Liberum which implied as little as 2% of the group’s profit could be at risk from this issue.

Underlying revenue growth of 4% for the group as a whole was in line with what the company typically delivers and management expressed their confidence in delivering another year of revenue, profit and earnings growth.

As we discussed when adding the stock to the Great Ideas portfolio in March, chief executive Erik Engstrom has done a good job of adapting the business to structural changes in the media sector and in our view this remains a high quality stock which does not look too expensive relative to its quality.

The shares trade on 19 times 2019 forecast earnings per share of 89.5p.

‹ Previous2018-08-16Next ›

magazine

magazine