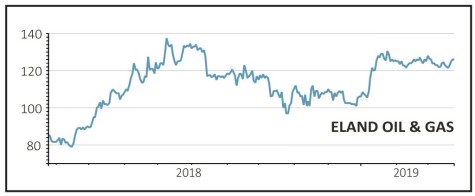

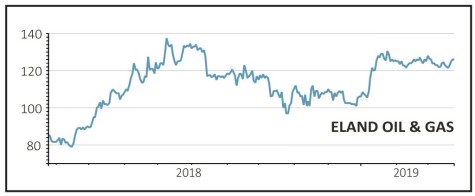

Eland Oil & Gas (ELA:AIM) 125p

Gain to date: 18.5%

Full year results on 20 March only increased our faith in Nigerian oil producer Eland Oil & Gas (ELA:AIM).

They fully reflect the progress the company has been making on the ground in the West African country with 100% growth in production to 8m barrels of oil equivalent per day (boepd) resulting in record revenue and pre-tax profit of $169m and $77.6m respectively.

In a show of faith in the company’s prospects, and a signal that it sees its shares as being undervalued, the company announced plans to extend its share buyback which commenced in the fourth quarter of 2018 from £3m to £6m.

The company also reaffirmed plans to start paying a dividend, with a maiden payout for the full year to 31 December 2019.

An extended lending facility gives the company the financial firepower to accelerate development of its assets, such that it should be on course to deliver a further 100% increase in production up to 17m boepd.

SHARES SAYS: Keep buying the shares. An exploration well on the Amobe prospect offers a further catalyst when drilling gets underway in the third quarter.

‹ Previous2019-03-28Next ›

magazine

magazine