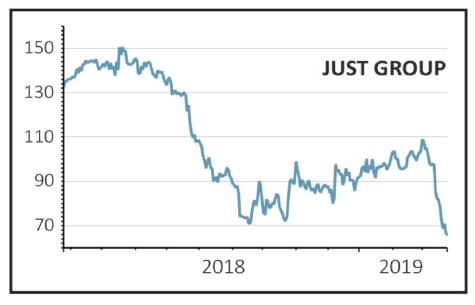

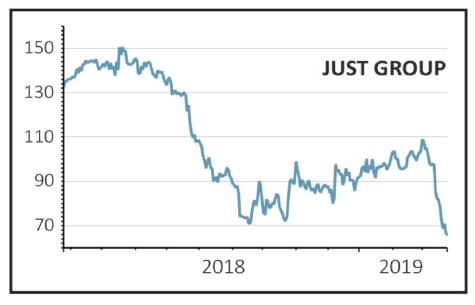

On 14 March retirement solutions firm Just Group (JUST) caught the market by surprise when along with its full year earnings it slipped out the news that is was raising £375m in new capital. The shares shed 12% to 85.3p on the day.

On 25 March it announced that the capital raise, consisting of £75m of new shares and £300m of Tier 1 bonds, was complete and it was back to business as usual.

Instead of rejoicing, however, investors have continued to sell the shares down to 66.75p.

Just Group needed to raise capital after the Prudential Regulatory Authority (PRA), a financial regulator, suggested last year that the insurance industry should account for equity-release mortgages more conservatively and put aside more reserves.

The £300m of bonds qualify as regulatory capital under the Bank of England’s Solvency II regulations which strengthens the firm’s previously tight balance sheet, but as chief executive Rodney Cook admits this new capital ‘has come at a cost’.

EXPENSIVE DEBT

The bonds pay an annual interest rate of 9.375% — nice if you can get it when UK Government bonds are yielding just 1% but not so nice if you are Just Group and have to fork out the interest every six months.

With the firm re-capitalised and the shares at their lowest price for 10 years, analysts have taken note.

The consensus is that the stock deserves to re-rate to a higher multiple of earnings, despite the fact that for the next few years earnings are going to be at least 30% lower than previous forecasts.

Despite future regulatory uncertainty and the impact to earnings from the capital raise, which could affect the group’s interest cover and therefore its credit rating, analyst Barrie Cornes at Panmure Gordon goes a step further and suggests that a trade buyer is likely to swoop because the shares have fallen too far.

While Just Group shares have fallen a long way and may be cheap on some metrics, without some kind of catalyst they are likely to stay cheap. And if a trade buyer is interested, it is unlikely they will pay much of a premium.

‹ Previous2019-03-28Next ›

magazine

magazine