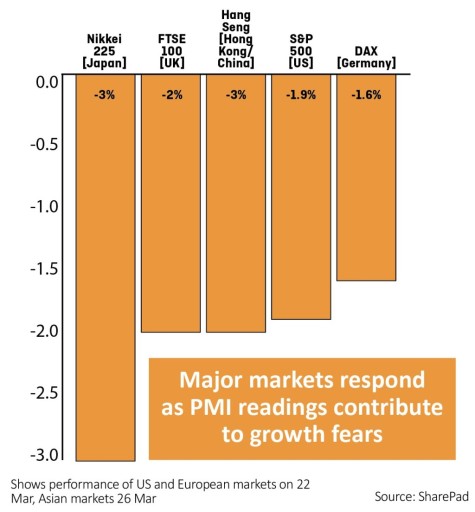

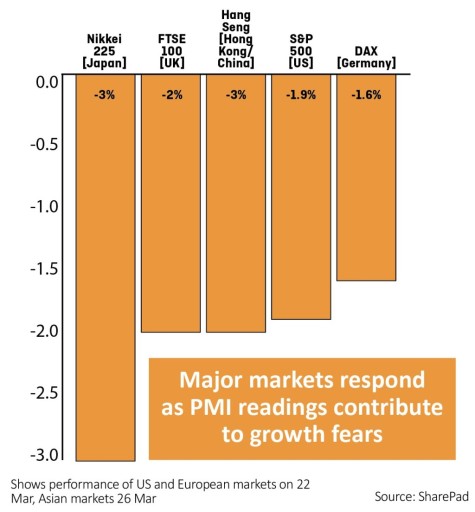

The VIX measure of market volatility hit its highest level in weeks on 22 March as investors took fright at a series of alarming economic updates from the US and Europe and the cautious tone sounded by America’s rate-setting Federal Reserve.

While shares are currently recovering from the sell-off, the return of market volatility is likely to continue as fears over global growth mount, and amid ongoing tensions on trade between the world’s two largest economies (US and China) as well as the latest developments on Brexit.

The next big economic announcement for investors to watch is the US non-farm payrolls data on 5 April. February’s data came in significantly below expectations, with the weakest job growth in nearly one-and-a-half years.

PMI (purchasing managers’ index) data is also closely watched by investors as it is based on a survey of the professionals who buy in the goods and services required by a company for its day-to-day activities.

The requirement for these managers to have a good insight into the levels of demand enjoyed by their businesses means these readings tend to carry significant weight.

The Eurozone composite PMI, covering a range of different sectors, fell from 51.9 in February to 51.3 in March. A figure above 50 signals expansion while anything below this threshold means activity has contracted.

According to Capital Economics, a consultant, the latest Eurozone PMI figure implies quarter-on-quarter GDP growth of just 0.2% in the first three months of the year. ‘More worryingly, Germany’s manufacturing PMI has dropped to its lowest since 2012, when the economy was in a deep recession, and France’s also fell below 50,’ it adds.

The US manufacturing PMI slipped to a 21-month low in March, down from 55.5 to 54.3.

Export-driven economy Japan saw its headline stock index the Nikkei 225 fall 3% on 25 March before recovering a good chunk of that ground on 26 March. In all since the 22 March the Nikkei has traded in a fairly wide range of nearly 4%.

‹ Previous2019-03-28Next ›

magazine

magazine