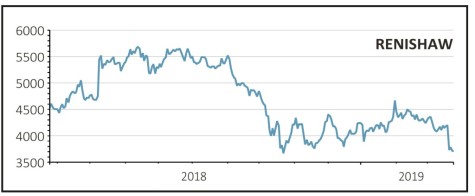

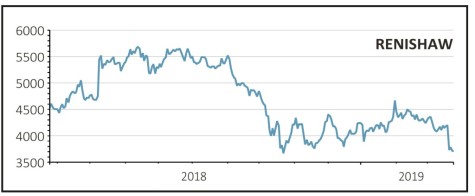

Renishaw (RSW) £37.10

Loss to date: 2.5%

A profit warning from precision engineer Renishaw (RSW) has wiped out all our earlier gains, putting the trade a touch below our December entry point.

Asian weakness is to blame amid a slowdown in demand for its encoder products and from large end-user manufacturers of consumer electronic products.

The Far East accounts for 43% of group sales so the profit warning means Renishaw is now a much higher-risk stock to own.

We acknowledge there are headwinds but we hope this is simply a bump in the road for what remains a high quality business. Renishaw has been through such issues in the past and come out fighting and we expect the same again.

It is also worth noting that the business isn’t solely dependent on the consumer electronics sector as it has a growing business serving the healthcare sector including systems for the dental industry.

Chief executive William Ernest Lee invested nearly £38,000 of his own money in buying shares immediately after the profit warning, which sends a vote of confidence to the market in the company’s outlook.

SHARES SAYS: Renishaw’s shares are likely to be volatile until it can prove that issues in Asia aren’t getting any worse.

Its next scheduled announcement is a trading update on 14 May, coinciding with a big event at its headquarters for shareholders, analysts and brokers to better explain its business. We suggest you keep hold of the shares.

‹ Previous2019-03-28Next ›

magazine

magazine