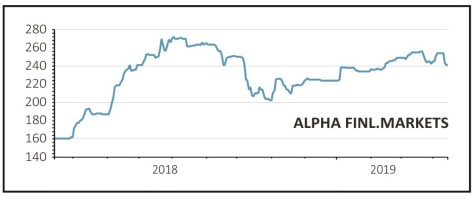

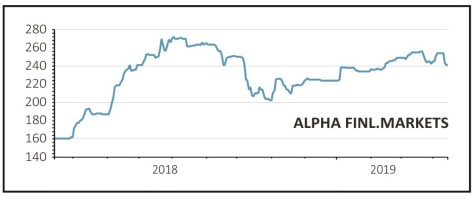

Alpha Financial Markets Consulting (AFM:AIM)

Price 242p. Gain to date: 2.5%

Alpha FMC (AFM:AIM) may not be a household name but it is a leading global provider of specialist consultancy services to the wealth and asset management industry and counts three quarters of the world’s top 20 firms measured by assets under management as its clients.

In its latest trading update the company confirmed that both revenues and earnings before interest, tax, depreciation and amortisation (EBITDA) for the year to 31 March would be well ahead of last year and comfortably in line with current forecasts.

As the wealth management industry grows and regulation increases, its customers are asking Alpha for more advice and services.

To this end it continues to expand its product range and has recently launched its twelfth practice, Exchange Traded Product (ETF) & Indexing.

It has also recently opened its tenth office, located in Zurich, as demand grows for its services outside its UK market.

At the half year stage last September turnover was up 35% to £39m while EBITDA was up 45% to £8.5m and net profits were up 57% to £6.3m.

For the full year analysts have pencilled in revenues of £75m and EBITDA of £16m. Alpha reports full year earnings on 5 June.

SHARES SAYS: We remain positive.

‹ Previous2019-04-18Next ›

magazine

magazine