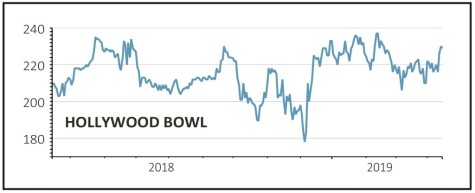

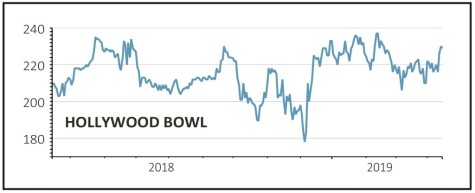

Hollywood Bowl (BOWL) 235.5p

Gain to date: 7.2%

Hollywood Bowl (BOWL) continues to deliver strong trading as its strategy of sprucing up existing sites and improving the customer experience is paying off.

The company wants to bring in more visitors and encourage them to return by offering cheaper prices at off-peak times, as well as promoting its VIP lanes and digital scoring system.

In the half year to 31 March, the UK’s largest ten-pin bowling operator revealed like-for-like sales rose 4.4% thanks to revenue growth across the business, including food and drink.

Hollywood Bowl recently refurbished sites in High Wycombe and Wigan, and remains confident of reaching its target of between seven and nine refurbishments by 30 September.

It has also opened bowling sites in Watford and the Lakeside shopping complex in Essex. The latter is particularly significant as it is the largest bowling centre to open in the UK over the last 10 years at 34,000 square feet.

Berenberg analyst Owen Shirley says his forecast 5% like-for-like sales growth over the year to 30 September may be too conservative, flagging a softer comparison in the second half of last year.

SHARES SAYS: We are confident Hollywood Bowl’s simple yet effective strategy will continue to reap rewards.

Keep buying.

‹ Previous2019-04-18Next ›

magazine

magazine