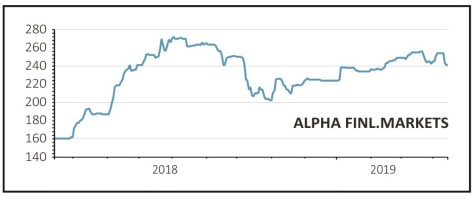

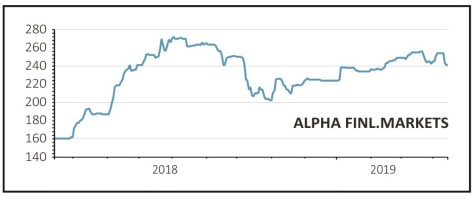

National Grid (NG.) 819.1p

Loss to date: 4.4%

For a supposedly dull but reliable inflation-proofed income stock National Grid (NG.) has been surprisingly erratic since we flagged the opportunity in November, taking in share price peaks and troughs of 889p and 749p respectively.

Two sizeable elephants remain in the room; dividend sustainability in light of more hawkish regulator demands and longer-term, the threat of nationalisation in any future Labour government.

The BBC most recently ran with that particular baton in late March, which presumably explains the more recent stock price weakness.

This latter point has been played down by many City analysts, not least because of the ‘financial and legal complexities that would have to be surmounted,’ in the view of investment bank Berenberg.

More urgent is the implied threat to dividends as Ofgem tightens the screw on cost of equity returns to 4%, hoping to save British consumers what it estimates to be around £6.5bn.

The immediate payout looks safe enough, with 47.3p expected to be announced when the group reports full year results to 31 March 2019 in May. Consensus estimates see that expanding to 48.7p in 2020 and 50.2p for 2021.

SHARES SAYS: At this stage a cut to dividends looks unlikely, and that implies an attractive 5.7% 2020 yield on our original entry price.

‹ Previous2019-04-18Next ›

magazine

magazine