Since Baillie Gifford took over the running of the trust from Schroders in 2018 Baillie Gifford UK Growth (BGUK) has enjoyed a strong performance.

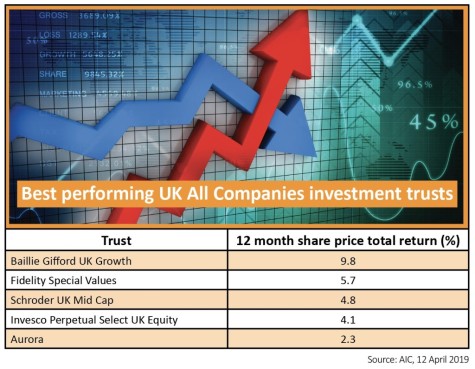

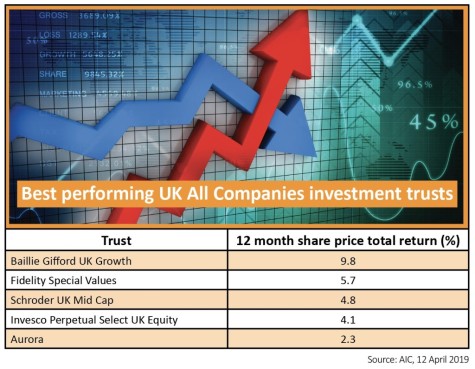

In share price terms, the trust is the UK’s best performer across the entire Association of Investment Companies UK All Companies grouping, over the last 12 months (see table).

Steered by Milena Mileva and Iain McCombie the trust’s showing is somewhat surprising given the problems encountered by two of the stocks the pair have added to the portfolio.

As at 28 February precision equipment manufacturer Renishaw (RSW) represented 3.6% of the fund and fashion brand Ted Baker (TED) 2.9%, with both among the top 10 holdings.

Yet Renishaw, which is also one of Shares’ key selections for 2019, saw a strong start to the year in share price terms wiped out after a profit warning linked to faltering Asian demand (21 Mar).

And Ted Baker’s problems have been well publicised as founder and CEO Ray Kelvin departed in March amid a storm of harassment allegations.

It is worth noting that these selections and the entire strategy of the fund are not focused on the short-term, indeed Mileva told an audience of journalists at an investment trust event late last year that she would be happy to hold Renishaw for the next decade or more.

Other constituents of the portfolio have helped compensate, with second hand car platform Auto Trader (AUTO) and safety equipment maker Halma (HLMA) to the fore.

Second on the UK All Companies list is Fidelity Special Values (FSV). The contrarian trust is managed by Alex Wright who focuses on unloved UK PLCs. The latest commentary from the trust noted: that the ‘deeply unloved status of the UK market has created an exceptionally fertile period for contrarian stock picking’. Its top position is in Irish building products firm CRH (CRH).

‹ Previous2019-04-18Next ›

magazine

magazine