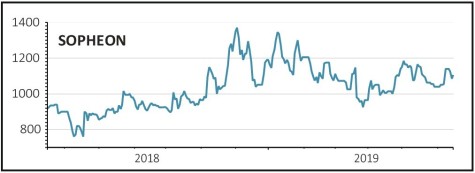

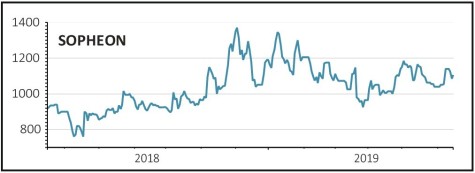

SOPHEON (SPE:AIM) £11.15

Gain to date: 19.9%

A detailed trading update from Sopheon (SPE:AIM) on 13 June confirms current performance momentum plus investment in future growth opportunities.

The innovation mapping software company is beginning to talk up digital transformation as a possible third pillar in the enterprise IT offering, alongside well established enterprise resource planning (ERP) and customers relationship management (CRM) themes.

This chimes with plenty of positives noises Shares has been hearing across the technology space.

Guidance is for growth to ease back somewhat in 2019 from the previous blistering pace. This is sensible management of expectations given the company’s reliance on landing larger licence deals.

However, recent new business wins in Thailand and Pakistan illustrate success in penetrating new territories and through new channel partners, and that could easily equate to a busier than currently expected second half.

SHARES SAYS: We have followed the story closely for more than two years, first pitching Sopheon as a Great Idea at 330p in June 2017, and hopefully many of our readers will have enjoyed the subsequent gains.

Yet if current target share prices hovering around the £15 mark prove accurate, there remains significant upside on offer even for new investors.

‹ Previous2019-06-20Next ›

magazine

magazine