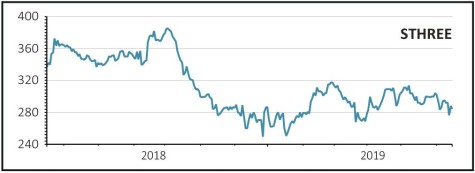

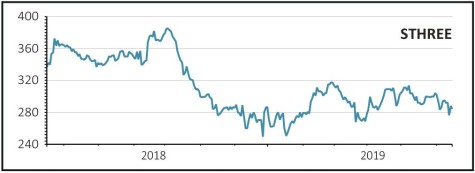

STHREE (STHR) 292p

Gain to date: 0.7%

Specialist recruitment firm SThree (STHR) posted a reassuring half-year update (14 Jun), putting it on track to meet its full year targets.

Group net fee income, also known as gross profit, grew by 9% to £163m in the first half driven by strong demand for contract staff in the US (up 22%), Continental Europe (up 16%) and Asia and the Middle East (up 15%).

The only region with negative growth was the UK and Ireland, as SThree restructured its UK business meaning a lower headcount and lower fees.

In its core disciplines of technology and life sciences, net fees rose in the first half with an accelerating trend in the second quarter. Encouragingly the energy sector sprung into life with 27% growth in net fees in the half, more than making up for a decline in banking and finance.

Demand for staff in the science, technology, engineering and mathematics fields is huge and growing and SThree is uniquely positioned to benefit among the London-listed staffing firms.

SHARES SAYS: SThree’s current rating of less than 10 times earnings undervalues the company’s growth prospects. Keep buying.

‹ Previous2019-06-20Next ›

magazine

magazine