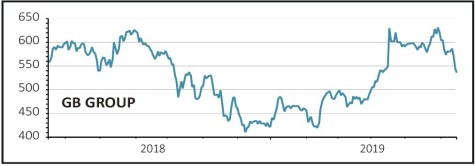

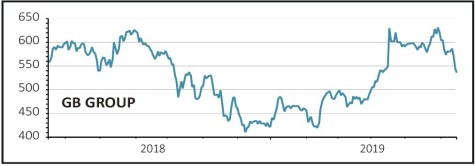

GB GROUP (GBG:AIM) 540p

Gain to date: 27.8%

Original entry point: Buy at 422.5p, 20 December 2018

A pause for breath was to be expected after such a strong start to the year for identity data intelligence expert GB Group (GBG:AIM). That the stock, one of our top picks for 2019, remains up by more than a quarter year-to-date even after two months of relative drift illustrates the point.

GB believes it holds a technology edge over competitors and we agree. Knock-out full year results on 5 June suggests that customers both new and old increasingly share that view. Revenue up 20% to £144m encompasses very decent 12% organic growth while expanding margins at 22.3% fired a 21.7% jump in operating profit to £32m.

Some working capital wobbles saw operating cash flow decline 12% to £27.8m and cash conversion dip to 81%, but we believe this to be a short-term effect that will iron itself out down the line.

Otherwise it is business as usual with international expansion and cross/up-selling very much the focus, supported by integration of Vix Verify and IDology, opening new and ‘significant’ opportunities in Australasia and the US respectively.

Updated market expectations call for £195m of revenue and £46m of earnings before interest, tax depreciation and amortisation, implying rough 35% growth on both measures.

SHARES SAYS: Typically impressive, GB remains a stand-out UK technology growth story.

‹ Previous2019-06-20Next ›

magazine

magazine