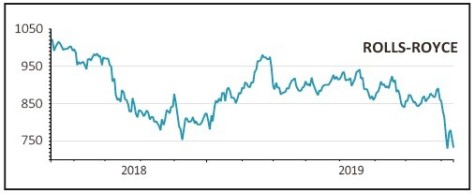

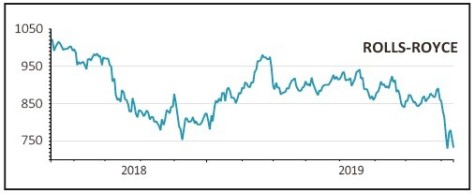

ROLLS-ROYCE (RR.) 733p

Loss to date: 8.6%

It’s been a testing summer so far for Rolls-Royce (RR.). Engine problems have dogged the aero-engineer after faults were found on its legion of Trent 1000 engines, which grounded planes at several airlines. Sorting that problem out will take a while and leave the group with a £1.6bn bill over the next few years, with the estimate increased another £100m confirmed at interim results (6 August).

This week has seen another calamity beset the FTSE 100 company as Italian investigators probe an incident in which a Norwegian Boeing 787-8 appears to have shed engine parts shortly after take-off from Rome. Analysts speculate that this relates back to durability problems of the compressor blades and turbines, but we’ll have to wait and see.

Clearly any in-flight failure is very serious and could signal a more significant financial impact of the Trent 1000 problems if, for example, they lead to further groundings.

Investors are in the mood to anticipate the worst and so the share price has fallen from end of July 891p levels.

The group remains on track to meet full year guidance for underlying operating profit and free cash flow of £700m and £100m, give or take, plus medium-term guidance to exceed £1.00 of free cash flow per share.

SHARES SAYS: We remain confident that short-term challenges can and will be overcome.

‹ Previous2019-08-15Next ›

magazine

magazine