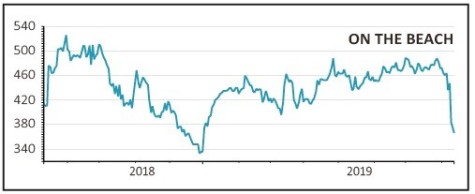

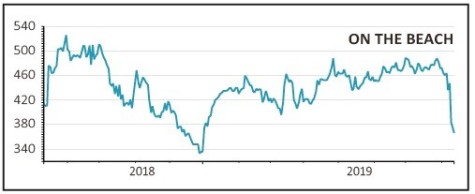

On The Beach (OTB) 368p

Gain to date: 1.7%

A recent profit warning from On The Beach (OTB) has virtually wiped out our gain, with shares in the online holiday retailer trading just 1.7% in the black.

While from a demand perspective the company is better insulated than its competitors when it comes to Brexit, one thing the firm has been caught out by is sterling, with the likelihood of a no-deal Brexit making the pound weaker.

In a trading update, On The Beach explained that, unlike its competitors, it constantly adjusts its prices to account for currency fluctuations rather than hedging against big foreign exchange movements.

Because sterling has significantly devalued against the euro from the start of May, with a sharp decline at the end of July and start of August, this has resulted in a marked increase in On The Beach’s prices compared to its rivals.

That has meant, despite growth in demand, the firm has struggled to gain market share while maintaining margins.

All of which has led the firm to tell investors that full year performance will be below expectations. The market has responded accordingly by effectively chopping off 80p from the company’s share price.

SHARES SAYS: On The Beach is still well-positioned in the industry for growth, but we’ll keep a close eye on trading.

‹ Previous2019-08-15Next ›

magazine

magazine