Travel operator TUI (TUI) allowed investors to breathe a huge sigh of relief after maintaining full year guidance despite plunging third quarter profits.

The all-inclusive holidays firm reported a near-60% fall in pre-tax profit for the three months and an underlying $200m loss for the first nine months of the year. The plunging pound keeping UK holidaymakers at home, ongoing Brexit uncertainty and the grounding of its fleet of Boeing 737 planes have all dragged on the company’s performance.

Shares in TUI dipped modestly at 808p.

The contrast with rival Thomas Cook (TCG) was stark, with the latter revealing on 12 August that it would need to raise £150m alongside the £750m already agreed with creditors to get through winter trading. The shares dived to fresh lows below 7p as shareholders reacted to the increased dilution.

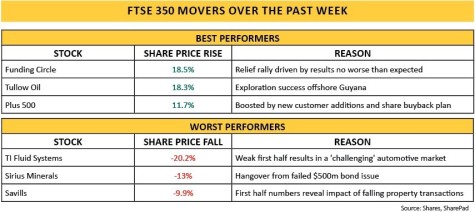

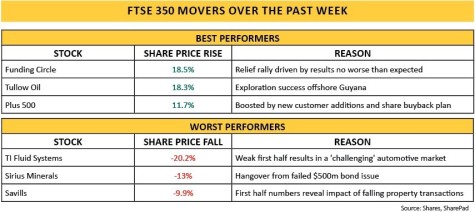

A much more positive story came in the form of a big oil discovery by partners Tullow Oil (TLW) and Eco Atlantic Oil & Gas (ECO:AIM) offshore Guyana.

After the successful outcome for Jethro-1, there is building excitement over future drilling on the Orinduik block, with drilling on a second well due to commence imminently.

The news represented a return to form for Tullow which previously reached the FTSE 100 off the back of several big oil and gas finds before falling back on oil price weakness, debt concerns production problems and a lack of drilling success.

On 8 August a mixed set of first half numbers from insurance firm Aviva (AV.) provided a measure of insight into new CEO Maurice Tulloch’s plans for the business, with the clearest signal yet that the company might consider selling off its Asian business.

Bookmaker William Hill (WMH) enjoyed a healthy bounce above 160p as results for the first six months of 2019 demonstrated progress in the key US market.

‹ Previous2019-08-15Next ›

magazine

magazine