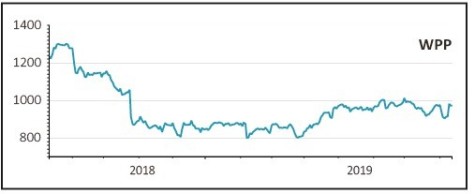

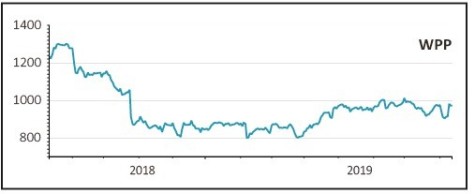

WPP (WPP) 981.2p

Gain to date: 14.9%

First half results (9 Aug) appeared to reward our faith in CEO Mark Read’s turnaround programme at advertising giant WPP (WPP).

Sensibly Read is keeping market expectations in check, however second quarter trading was slightly ahead of internal projections and external estimates which helped boost sentiment towards the stock.

WPP held its interim dividend per share steady at 2.7p and reiterated full year guidance for a 1.5% to 2% fall in like-for-like revenue less pass through costs. In the first half, revenue on that measure fell 2%, but in the second quarter by 1.4%.

The company was also able to point to client wins including L’Oreal, eBay and Instagram.

Shore Capital analyst Roddy Davidson says: ‘We are encouraged by the progress summarised in today’s results release which adds support to our view that the group’s strategy is gaining traction.

‘Specifically, we like its focus on simplifying operations; engendering greater internal cooperation; pursuing efficiencies; reducing debt; realising value from non-core operations and; generally enacting a more disciplined capital allocation policy.’

SHARES SAYS: An effective resetting of the bar by Read means even incremental improvements are likely to be rewarded by the market. Keep buying.

‹ Previous2019-08-15Next ›

magazine

magazine