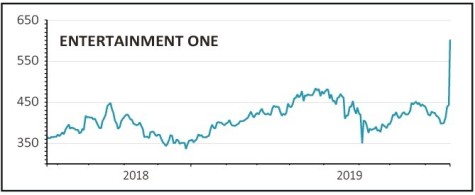

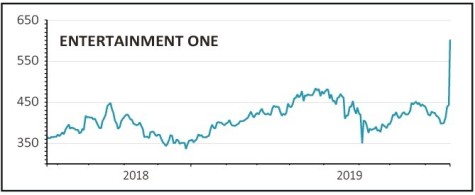

Entertainment One (ETO) 588.5p

Gain to date: 40.7%

Our positive call on TV and film rights business Entertainment One (ETO) is looking well timed as the company has received a 560p cash per share bid from US toy maker Hasbro.

As we write the shares are trading above this level, suggesting that the market is expecting a rival bid. This latest takeover offer for a UK firm suggests that recent weakness in sterling has acted as a catalyst for foreign predators.

We pointed out that the company’s Peppa Pig brand was the jewel in Entertainment One’s crown and it seems likely that this, along with other successful kids’ brands like PJ Masks, was what attracted Hasbro’s interest. Indeed the US firm suggests as much, flagging the pre-school brands in its rationale for the deal.

The identity of any potential rival bidder is up for debate with streaming giants Amazon and Netflix logical candidates given their need for the kind of premium content owned by Entertainment One. Disney, which is a part-owner of PJ Masks, is another possible suitor.

SHARES SAYS: While we normally like to lock in a profit upon a takeover approach, we’re minded to wait with Entertainment One and see if a better offer comes along. Shareholders should sit tight.

‹ Previous2019-08-29Next ›

magazine

magazine