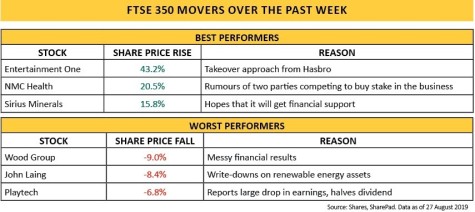

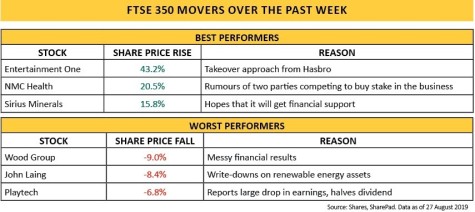

Shares in healthcare provider NMC Health (NMC) rocketed on reports that two groups, one backed by China’s Fosun, were competing to buy a 40% stake in the company at a premium to the market price.

The company’s shares soared as much as 42% to £27.48 on news of the possible deal, having traded at a 12-month low just the day before.

Meanwhile a lifeline could be provided to ailing FTSE 250 potash miner Sirius Minerals (SXX) and its 85,000 private investors, with the UK Government being urged to provide emergency financial support, according to the Mail on Sunday.

Sirius pulled a $500m bond offer earlier this month, blaming market conditions. It needs that cash to get the $2.5bn being put up by JP Morgan.

Shares in the embattled Woodford Patient Capital (WPCT) plunged even further to just 40p after it revealed the value of its assets dropped by 3.6%.

Driving the overall cut was the downward revision of its holding in Industrial Heat. Aiming to develop cold fusion, investors including Neil Woodford and celebrities like Brad Pitt have poured over $100m into it. But it has been a terrible performer in Woodford’s portfolio, and is currently no closer to developing cold fusion.

Infrastructure investor John Laing (JLG) fell nearly 9% over the past week following a large drop in earnings and news that it was putting new investment in renewable energy on hold in Australia and Europe.

Returns from wind assets in Europe disappointed, leading to a £55m hit on the value of the projects in that region. It also took a £66m write-down on its Australian renewable energy assets primarily because of industry transmission issues.

‹ Previous2019-08-29Next ›

magazine

magazine