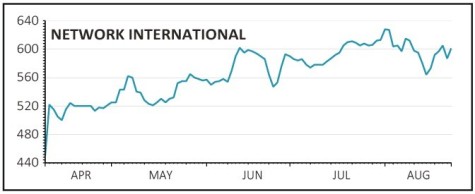

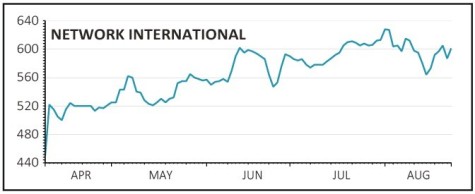

Network International (NETW) 597p

Gain to date: 7.8%

Our buy call on Middle East and Africa digital payments play Network International (NETW) is off to a steady start despite the recent market volatility.

The resilient share price performance was supported by the release of the first set of numbers since the company’s IPO in April. The first half results (14 Aug) contained relatively few surprises.

Pre-tax profit for the six months to 30 June fell to $18.9m, down from $38.6m but this mainly reflected costs associated with the stock market listing.

Revenue rose 12% to $152.3m, underlying earnings before interest, tax, depreciation or amortisation (EBITDA) rose 14% to $76.4m and underlying net income rose 5.1% to $43.8m.

The company also flagged operational progress in Saudi Arabia, which was one of the key growth avenues we flagged in our original article.

Responding to decent momentum in client wins in the country, Network has opted to incorporate a local company, establish a local office and look at potentially investing in further infrastructure, including a data centre.

Investment bank Liberum says: ‘We continue to believe that Network is uniquely placed to benefit from a number of structural growth drivers, providing the group with a number of options to create significant value for shareholders.’

SHARES SAYS: This is a story with long-term growth potential. Keep buying.

‹ Previous2019-08-29Next ›

magazine

magazine