The election of the perceived market-friendly Jair Bolsonaro as president in October 2018 has proved a strong catalyst for Brazilian equities in 2019.

The flagship Bovespa index is up a healthy 13.2% so far this year, compared with an 11.1% advance for the FTSE All-World, according to data from SharePad.

The Bolsonaro administration, which has attracted criticism for authoritarian tendencies and socially conservative policies, has nonetheless pleased foreign investors by announcing pension reforms and is beginning to look at the tax system.

It has not all been smooth sailing though with the government slashing its own GDP growth forecast for the year in half to 0.8% in July and unemployment still at elevated levels. In response finance minister Paolo Guedes announced plans to inject $11.2bn worth of stimulus to get the economy moving.

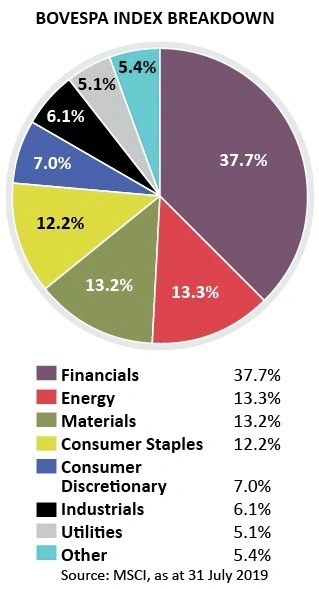

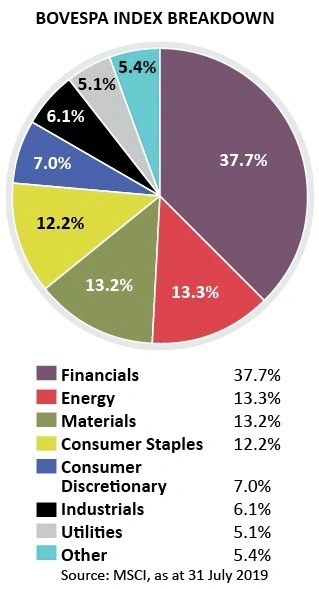

The MSCI Brazil index is designed to measure the performance of the large and mid-cap segments of the Brazilian market. With 55 constituents, the index covers about 85% of the Brazilian equity universe and therefore offers a good overview of the Brazilian stock market.

Although the country is rich in natural resources, financials is the sector with the heaviest weighting on the index and accounts for six out of the 10 largest constituents.

Brazilian banks have historically benefited from the dominant position of just a few operators, strong interest rates and the growth potential from operating in an inherently less mature market.

It is not unusual for banks in Brazil to deliver returns on equity upwards of 20%. At best UK banks operate at around half that level.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here

‹ Previous2019-08-29Next ›

magazine

magazine