Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Investors brace for a Brexit election

Something has finally happened with Brexit. MPs have finally agreed to have a general election on 12 December in attempt to find a way forward.

The market appears to be taking the news in its stride for now, however there is little question that uncertainty has been ratcheted up.

The timing of the election and a volatile electorate, which seems less attached to the main parties, mean that many expect this to be the most unpredictable vote in generations.

While Boris Johnson’s Conservative Party has a commanding lead in the polls, there is a chance this won’t translate into the majority in the House of Commons he craves.

An election itself could be good news for Royal Mail (RMG) as it gets paid to deliver election leaflets albeit the company also faces the prospect of a pre-Christmas strike.

The timing isn’t great for the retail sector – distracting people from their Christmas shopping just at the point you would expect festive trading to be in full swing.

There is likely to be demand for the services of polling firms like YouGov (YOU:AIM) although this activity actually represents a modest slice of the company’s business.

Housebuilders will be pleased the election is coming during a quiet period when they wouldn’t be selling many homes anyway.

WHAT WILL HAPPEN NEXT?

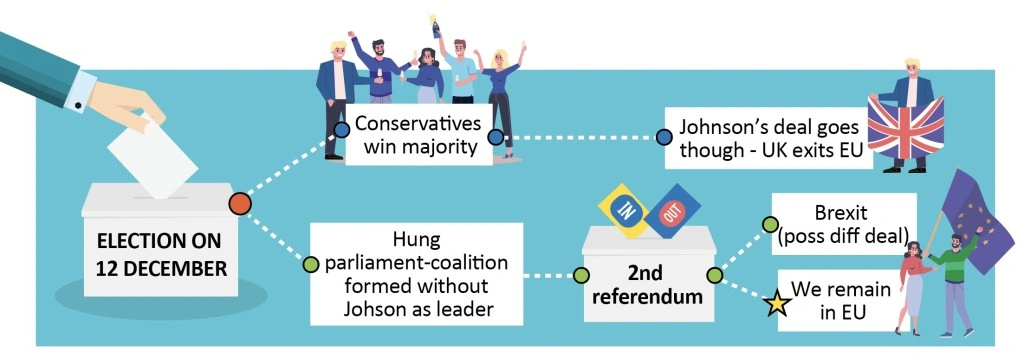

The specifics of the result are unpredictable but may go in one of two directions.

The first is that Johnson secures a majority and is able to steer his Brexit deal through parliament. In the short-term at least this would provide more clarity to business and would likely see a boost for sterling and other UK assets including real estate and banking and housebuilding shares.

Longer term there remains the uncertainty of negotiations over a future trading relationship and whether the current transition period provides enough time.

The other result which seems credible is another hung parliament. Johnson’s Brexit stance makes it unlikely he could form a coalition but this might be easier for Labour leader Jeremy Corbyn if he pledged to hold a second referendum. This would rely on the EU further extending the Brexit deadline.

Such an outcome would imply more uncertainty for business, not least because a Labour-led administration raises the sceptre of nationalisation for utility providers, shake up the transport sector and negatively impact some infrastructure funds.

On the flipside it could result in the market’s likely preferred outcome on Brexit of the UK staying in the EU.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine