Shares believes investors should buy cash generative books, magazines and stationery seller WH Smith (SMWH).

We’ve long been fans of the business and following a bold takeover roughly doubling the size of its international travel business we think there is scope for further upside.

The £312m acquisition of Marshall Retail, announced on 17 October, is being funded through debt and a £155m share placing.

TRAVEL TRANSFORMATION CONTINUES

WH Smith has been winning contracts to open airport stores around the globe and acquired digital accessories airport retailer InMotion last year.

The acquisition of Marshall Retail, a high-growth US travel retailer with stores in airports, resorts and tourist locations, will accelerate the growth of the international travel business and combined with InMotion, enhance WH Smith’s potential in a $3.2bn US airport travel retail market.

With 170 stores in North America at the last count, Marshall sells news, gifts and convenience products in high footfall locations to customers who are essentially ‘captive’, giving it a fair bit of pricing power.

ONGOING RESILIENCE

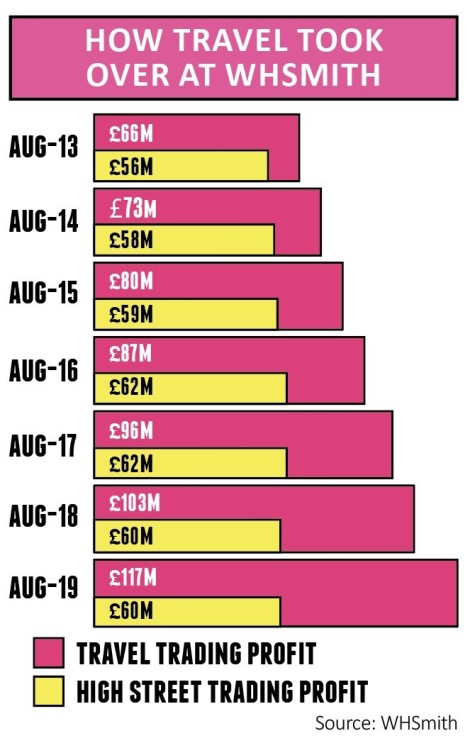

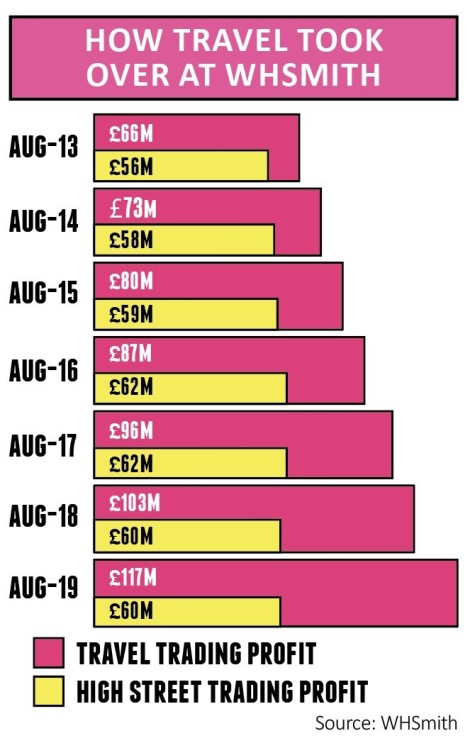

The Marshall deal was bundled up with robust full year results to 31 August 2019 showing a £10m (7%) hike in pre-tax profit to £155m on revenue up 11% to almost £1.4bn. Profit rose sharply in travel and was stable in the legacy high street business, where WH Smith continues to eke out cost savings.

Continuing to pay out generous dividends whilst using surplus cash to buy back shares, WH Smith also delivered another healthy dividend hike, up 8% to 58.2p per share. Investors were also encouraged by news of a ‘good start to the new financial year’.

‹ Previous2019-10-31Next ›

magazine

magazine