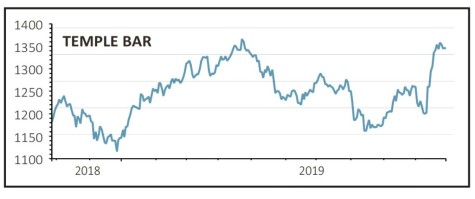

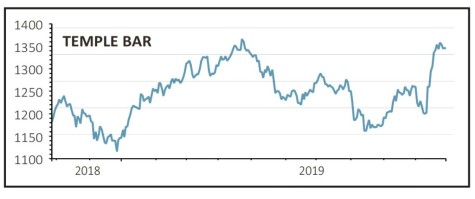

TEMPLE BAR INVESTMENT TRUST (TMPL) £13.48

Gain to date: 15.2%

Shares in investment trust Temple Bar (TMPL) have surged higher since our late summer ‘buy’ call, leaving our recommendation a handsome 15.2% in the money.

In anticipation of a rotation from growth to value, other investors have cottoned on to the attractions of this portfolio of cheap, dividend-paying stocks and the discount has narrowed from 6.3% to 3.2% accordingly.

We’re happy to remain buyers of Temple Bar, managed by renowned contrarian investor Alastair Mundy, in the belief the undemanding valuations in the underlying portfolio should limit downside during a market sell-off. One of The Association of Investment Companies’ ‘Dividend Heroes’, those trusts that have increased annual dividends for 20 consecutive years or more, Temple Bar has recently seen strong NAV growth.

It has benefited from share price increases from support services group Capita (CPI), drugs giant GlaxoSmthKline (GSK) and builders’ merchant Travis Perkins (TPK), banking groups Lloyds (LLOY) and Barclays (BARC). Also lending support has been Britain’s biggest retailer Tesco (TSCO) and recent gold price strength.

SHARES SAYS: Don’t be tempted to take profits. Now is the time to hold onto Temple Bar.

‹ Previous2019-10-31Next ›

magazine

magazine