The introduction of new more generous tax laws has helped to revive interest in the Indian investment story. Although growth expectations have taken something of a knock in recent months the long-term picture in the country is underpinned by several drivers not least the country’s favourable demographics.

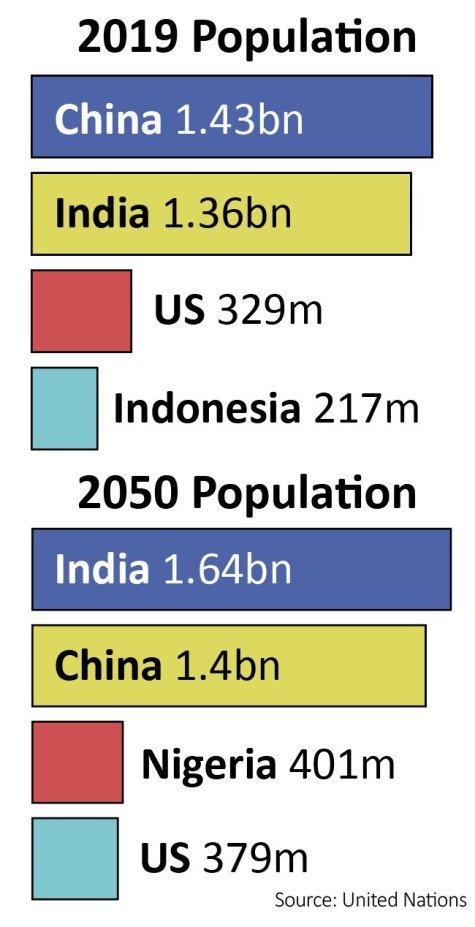

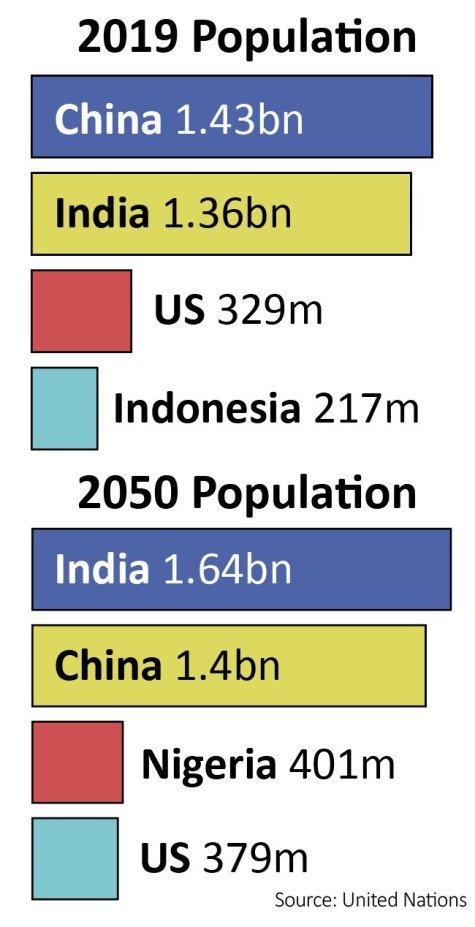

A recent report from the United Nations projected that India would overtake China as the world’s most populous country around 2027, with around 273m new Indians being added to the population between 2019 and 2050.

Having a growing and youthful population, around half of which is under 25, means plenty of new recruits for the jobs market and should also underpin long-term demand for housing, health care and consumer goods, particularly as incomes go up.

The growth of the middle class in India has been promised since the 1990s but has taken longer than forecast thanks to slower urbanisation than in other emerging economies like China and a more geographically and culturally diverse population.

However, the country now appears to be catching up with a middle class more than 100m strong. There has also been a shift away from agriculture to the manufacturing and services sectors and internet penetration is increasing rapidly. Meanwhile India is a democracy and has a relatively strong education system.

The backdrop is not unblemished however. The International Monetary Fund recently downgraded growth expectations for 2019 from 7% to 6.1%, citing weaker domestic demand and issues in the financial sector, but the organisation expects growth to return to the 7% mark in 2020.

‹ Previous2019-10-31Next ›

magazine

magazine