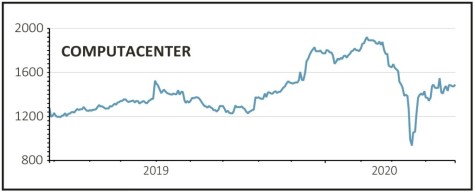

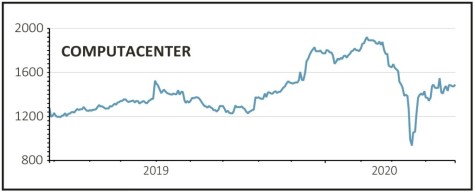

Computacenter (CCC) £14.90

Gain to date: 23.1%

IT re-selling outfit Computacenter (CCC) is navigating the coronavirus crisis well so far and we remain positive on the shares.

A first quarter update (23 Apr) saw the company pull its dividend but otherwise it was very reassuring with 2020 expectations unchanged (albeit with the caveat that the second-half is hard to predict) and first-half profit expected to be in line or slightly ahead year-on-year. In summary trading has not been as bad as feared.

The company enjoyed a boost to demand from the increase in working from home, reflecting its status as a provider of PCs, laptops and smartphones as well as software advice to millions of end-users and as a trusted partner for thousands of organisations.

On the flip-side the company saw demand drop off in the industrial sector and in Europe around 10% of its staff are on various state-backed furlough schemes.

In a sign of sound corporate governance, the company’s CEO Mike Norris and finance director Tony Conophy have announced they will reduce their salary to zero through to the end of June to show solidarity with their furloughed employees.

SHARES SAYS: While the end to a proud dividend track record is disappointing we remain fans of this resilient business.

‹ Previous2020-04-30Next ›

magazine

magazine