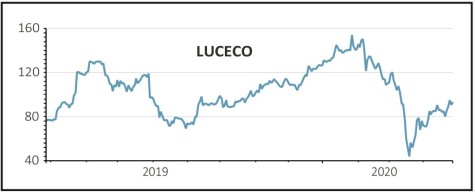

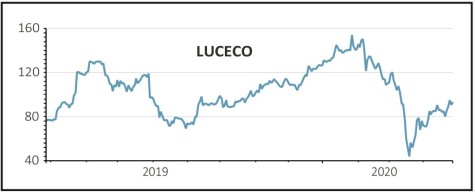

Luceco (LUCE) 94p

Loss to date: 8.6%

Original entry point: Buy at 116p, 19 December 2019

We may be out of pocket on our ‘buy’ call on electronic components firm Luceco (LUCE) but the shares have doubled from their bottom at the height of the coronavirus-inspired market sell-off.

Sentiment was helped by full-year results on 23 April which revealed a 470% increase in pre-tax profit.

Luceco supplies a wide range of electrical and wiring products to retail and wholesale markets, encompassing industries like construction, housebuilding and housing maintenance.

The company was hit early amid the panic over the virus given the feared impact on its supply chain in China.

However Luceco confirmed alongside its full-year numbers that the disruption to product supply had gone by the end of the first quarter.

The issue now is likely to be demand. Signs of construction activity picking up as lockdown conditions are eased offer some reasons for hope.

The company has also moved to secure its financial position by loosening banking covenants and applying for the COVID Corporate Finance Facility.

Numis analyst Kevin Fogarty says: ‘Even on our lowered forecasts, the implemented cost mitigation initiatives and additional financial headroom implies that Luceco has sufficient liquidity to move beyond the darkest hour and capture the upside of any medium-term demand recovery.’

SHARES SAYS: Still a buy.

‹ Previous2020-04-30Next ›

magazine

magazine