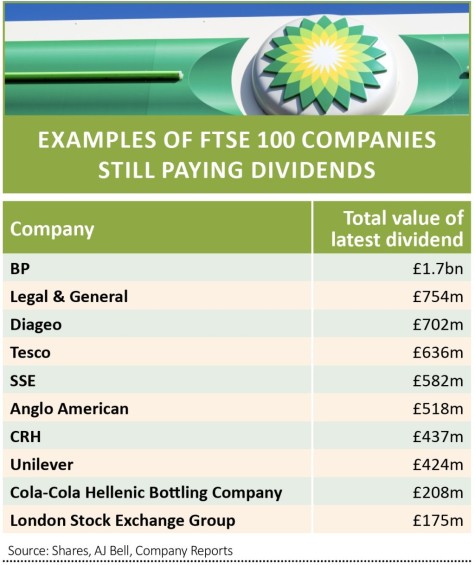

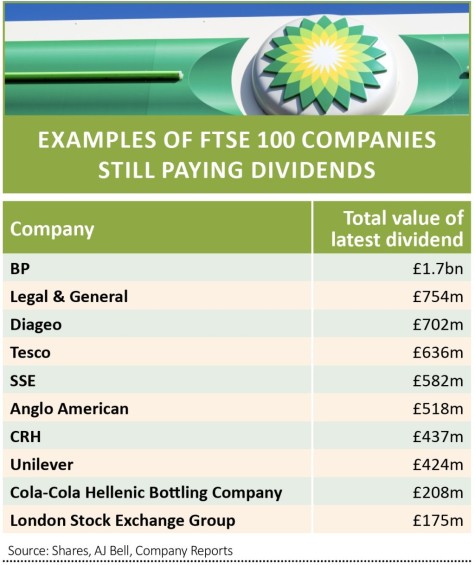

Oil and gas giant BP (BP.) has shown there are still some dividend payers on the FTSE 100 after committing to a $2bn payout despite reporting a $4.37bn loss for the first three months of 2020.

Increasing numbers of companies are cutting dividends as more and more look to preserve cash to survive the economic fallout from the coronavirus pandemic, but there still some like BP which have committed to keeping their shareholder payouts intact.

The BP payout, which came despite the massive loss and its debt levels rising above target to $51.4bn, follows the likes of other FTSE 100 names of late such as Unilever (ULVR), Croda International (CRDA) and Pearson (PSON) which have kept their dividends intact.

Chemicals company Croda said it has for many years operated a ‘prudent’ dividend distribution policy, which has allowed it to continue to pay its 50.5p per share final dividend, around £65m in total, for 2019.

Education publisher Pearson pointed to its ‘strong financial position’ with a ‘healthy’ balance sheet, low net debt and good liquidity as it increased its 2019 final dividend by 4% to 19.5p per share.

It’s not just large cap companies which are able to keep paying. Notably AIM-quoted self-storage play Lok’n Store (LOK:AIM) announced a 9% increase in its first half dividend to 4p.

With trading resilient for now, its cost of debt falling to 1.7% and the company ‘very conservatively financed’ CEO Andrew Jacobs told Shares he can see little reason to cut the dividend at the moment.

So far 37 FTSE 100 firms have announced cuts to their dividends, with only 16 currently committed to keeping theirs intact.

According to Canaccord Genuity Wealth Management’s senior equity analyst Simon McGarry, in a worst case scenario up to 50% of

the UK’s dividend income might disappear in the first half of 2020.

But he highlights five sectors where dividends look relatively resilient. These are mining, the tobacco sector which has seen resilient demand and boasts highly cash generative companies, food retailers like supermarkets, oil companies committed to their dividends like BP and Royal Dutch Shell (RDSB), and fund managers such as Schroders (SDR) and Standard Life Aberdeen (SLA) which have strong balance sheets and excess capital.

‹ Previous2020-04-30Next ›

magazine

magazine