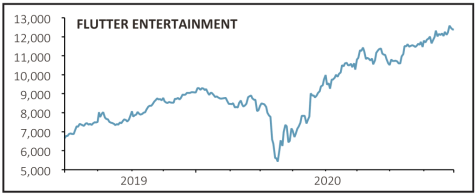

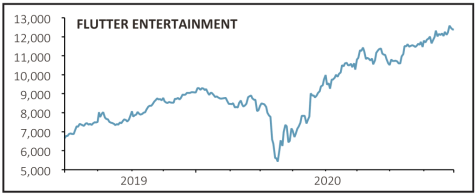

Flutter Entertainment (FLTR) £124.2

Gain to date: 14.2%

Original entry point: BUY at £108.75, 2 July 2020

Betfair and Paddy Power owner Flutter (FLTR) revealed half-year results on 27 August, the first time investors got a glimpse of what the business looks like after the tie-up with Canadian sports betting group Stars Group.

Pro-forma revenue was up 21% to £2.4 billion and adjusted operating profits up a very impressive 35% to £567 million. Pro-forma numbers reflect the combined businesses as if they were one entity for the full reporting period.

Our enthusiasm for the shares is related to the momentum the group is building in the US market, which could be a game-changer. The signs remain positive with the company claiming sports and gaming market leadership during the first-half with 44% of the online sports book and 27% of online gaming.

Investment in Michigan and Illinois has been brought forward, moving the company towards its goal of offering FanDuel’s online sportsbook to 21% of the US population by 2021.

Another key attraction for us is Flutter’s focus on acquiring customers as they migrate from retail to online. Retail brands retain only 40% to 50% of migrating customers and the pandemic has accelerated the trend towards online. Given that 88% of the global gambling market is still offline, this represents significant future growth potential.

‹ Previous2020-09-03Next ›

magazine

magazine