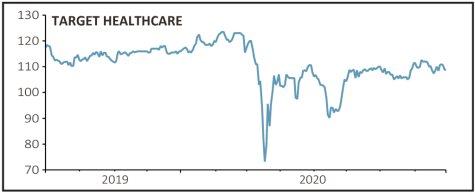

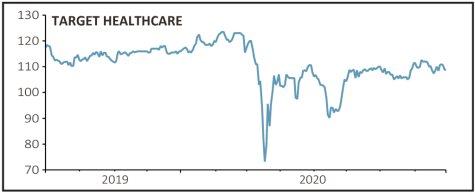

Target Healthcare REIT (THRL) 112.8p

Gain to date: 5.6%

Original entry point: Buy at 106.8p, 16 July 2020

Care home investor Target Healthcare (THRL) is off to a decent start as one of our Great Ideas.

The shares have risen modestly, supported by a positive recent update (5 Aug) which revealed a slight increase in its net asset value per share from 108p at the end of March to 108.1p as at the end of June and robust rent collection.

Given we flagged the company’s income appeal in our initial article it was also pleasing to see the quarterly dividend nudged up by 1.5% to 1.67p per share.

On an annualised basis that would equate to a payout of 6.68p and a yield of 5.9% at the current share price.

Stockbroker Numis commented: ‘Target Healthcare’s continued robust performance reflects the defensive characteristics of the portfolio despite the care home sector featuring heavily in the news during the midst of the Covid-19 pandemic. The board has been able to maintain the dividend at the targeted level on the back of strong rent collection figures (96% for Q3 as at 6 July).’

SHARES SAYS: We continue to see Target Healthcare as a

relatively lower risk way of accessing a generous stream of income.

‹ Previous2020-09-03Next ›

magazine

magazine