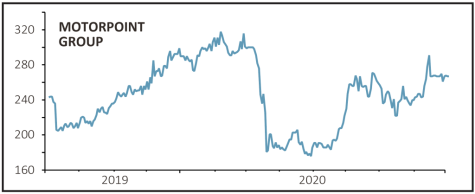

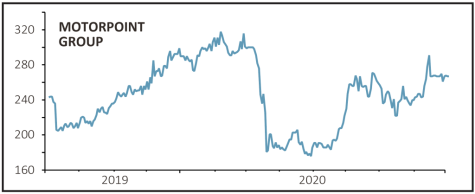

Motorpoint (MOTR) 270p

Gain to date: 42.1%

Original entry point: Buy at 190p, 14 May 2020

We are encouraged by fresh evidence of strong post-lockdown trading at car dealership Motorpoint (MOTR).

A positive update on trading accompanied the company’s AGM on 24 August, with key operational and trading metrics over the last 11 weeks ‘comfortably ahead’ year-on-year according to the group.

News that chief financial officer James Gilmour is leaving the company is a modest blow – broker Shore Capital describing him as ‘well-regarded’ – but not a reason to change our view on the stock. Particularly as Gilmour is sticking around for a while to ensure an orderly transition.

As Shore analyst Darren Shirley notes, caution remains on the sustainability of any recovery in consumer confidence due to the lasting impact of Covid-19, and how trading will evolve as we move into the autumn and beyond.

‘How much of current trading still reflects pent-up demand from lockdown? How much is the group’s disruptive model driving share gains?’ he asks.

We should get some answers with a first-half trading update on 8 October with Shore Capital planning to reinstate earnings forecasts at that point.

SHARES SAYS: Still a buy for now, we will keep a close eye on October’s trading statement and updated forecasts.

‹ Previous2020-09-03Next ›

magazine

magazine