Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

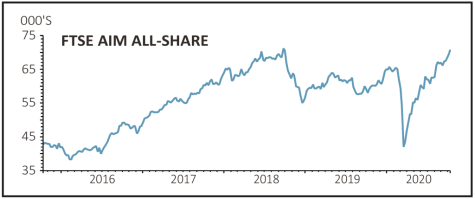

AIM index regains strength and US tech stocks rally again

While the FTSE 350 and FTSE All-Share indices remain well below all-time highs, the AIM market has been on tear, recovering all the losses suffered during the lockdown-induced sell-off in March.

Across the Atlantic the US technology sector-dominated Nasdaq 100 index registered its biggest one-day gain since April on 12 October, up nearly 3% driven by a 6% pop in Apple ahead of a product launch event.

In the six months before Apple’s eight previous major generational product launches, dating all the way back to the original iPhone in 2007, its shares have risen by an average of 20%, only to move up by 4% on average in the six months after launch.

Amazon surged 5% higher as it geared up for the launch of its Prime Day sales bonanza where it slashed prices for two days exclusively for its members.

Shares in engine maker Rolls-Royce (RR.) have been on quite a rollercoaster ride over the last couple of weeks with the shares doubling in price between 2 and 9 October after US investment manager Capital Group revealed an 8.7% stake. Having gone on to hit 235.5p on 12 October, they then pulled back sharply to 185.5p the following day.

Car dealership Marshall Motors (MMH:AIM) surprised investors by saying it expects to generate an underlying pre-tax profit of £15 million for the year to 31 December. That is quite a jump from previous guidance of break-even. Strong trading continued through August while it saw a bumper performance in the all-important September plate-change month. The shares rallied 10% on the news (13 Oct).

Shares in respiratory drug development company Synairgen (SNG:AIM) jumped 50% between 7 and 12 October. While there wasn’t any company-specific news behind the move there is increasing optimism about the prospects for the company’s SNG001 drug as a treatment for hospitalised Covid-19 patients.

Bus company FirstGroup (FGP) saw its shares rise by 31% over the last week on higher than average volumes of shares traded, but no company news. Activist investor Coast Capital, which lobbied for a break-up of the company, remains the largest shareholder with a 13.8% stake.

One of the biggest casualties in the past week was pharmaceutical therapeutics company 4D Pharma (DDDD:AIM) which cratered 38% to 100p despite reporting positive phase two trial results for its irritable bowel syndrome drug. The share price had increased nearly five-fold since July when the company raised £7.7 million from shareholders at 35p.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine