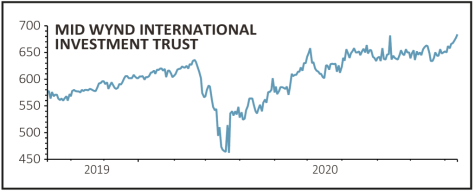

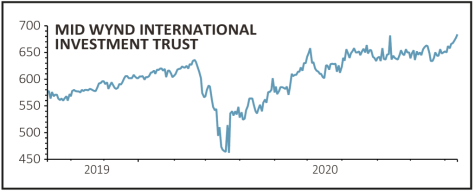

Mid Wynd International Investment Trust (MWY) 678.59p

Gain to date: 17.2%

Original entry point: Buy at 578.94p, 5 March 2020

Anyone holding shares in global equities investor Mid Wynd (MWY) should be pleased given how the stock is on the cusp of hitting a new all-time high.

At 678.59p, Mid Wynd is just below the 682p record high seen in August this year, with the shares having perked up in the past few weeks.

The investment trust has stakes in a broad range of companies, from tech including Amazon and Microsoft to healthcare (Merck and Roche) and consumer goods (Reckitt Benckiser (RB.)).

Fund manager Simon Edelsten says he has focused on creating a balanced portfolio and looks for less fashionable growth stocks on reasonable valuations. This has resulted in 12% of the portfolio’s assets being in Japan and over 7% in China and elsewhere in Asia.

‘These holdings dominated the fund’s returns in September with Daifuku (automated warehouses), Keyence (automation control systems) and Hoya (eyeglasses and lithography plates for making semiconductors) leading the way,’ adds Edelsten.

Over the past five years Mid Wynd has achieved 17.05% annualised returns versus 14.2% from the FTSE World Total Return benchmark, according to Morningstar.

SHARES SAYS: This should be viewed a long-term holding and it’s pleasing to see the investment trust continue to deliver strong returns. Keep buying.

‹ Previous2020-10-15Next ›

magazine

magazine