Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

European stock recovery is picking up pace

Investors should be watching European markets closely as there is a lot of positive news coming from companies and interesting share price movements in recent weeks.

A trio of firms caught the market’s attention on 9 October by increasing their earnings guidance for the year. Retailers Pandora and Zalando as well as drugmaker Novo Nordisk were all in demand after respective management gave an upbeat view of their earnings potential.

In mid-September fellow retailer H&M said it would return to profit on stronger than expected recovery. Around the same time, Spain’s Inditex said current trade was returning to normality, with online sales growing sharply and store sales recovering.

Also catching our attention has been a tick up in the Euro Stoxx Banks 30-15 index, signalling that investors are becoming more interested in bombed-out financial stocks, perhaps because they are very cheap. The index, which tracks the performance of 22 banks in countries such as France, Germany, Portugal and Spain, has risen by 9% since 25 September.

This is interesting given the prospect of rising bad debts among consumers and businesses, together with expectations for low interest rates, would suggest the banking sector is unappealing.

However, there continues to be signs of a resurgence in value investing where people are looking to buy cheap stocks that could revert to fair valuation once economic prospects improve.

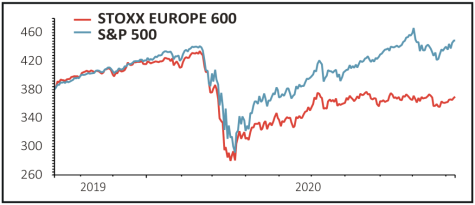

This year’s winning trade has been buying the US market, in particular tech stocks. Shares gets the impression that there is growing fatigue from parts of the investment market towards the US due to high valuations. That might explain why investors are sniffing around elsewhere for opportunities. The UK is cheap but still has the cloud of Brexit hanging over it, so Europe is arguably a good alternative for those looking to redeploy some of their US profits.

The Euronext 100 index has been keeping pace with the S&P 500 since 25 September, both rising by 5%. On a year-to-date basis the Euronext has lagged with a 14.4% loss versus a 6.5% gain from the US index.

If you look at Europe on a broader basis including the UK via the Stoxx 600 index, even that is doing its best to play catch-up, with 4% gain since 25 September. Naturally these are very short time periods and the direction of travel could easily swing the other way.

‘Despite concerns that the recovery in the euro area may go into reverse in Q4 in the face of rising Covid cases and intensifying government restrictions, at the moment, our data suggests that activity is still holding up reasonably well,’ says Marchel Alexandrovich, European economist at investment bank Jefferies.

Shares discussed the opportunities for European stocks in a recent article and we now have even stronger conviction with this market.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine