Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Forget tech, solar and clean energy is the hot sector in 2020

The big US and Chinese tech stocks aren’t the only ones bouncing back from the Covid-induced market sell-off to record large gains in 2020.

A number of funds, exchanged-traded funds (ETFs) and stocks in the renewable energy space have also soared year-to-date.

Take US-listed Invesco Solar ETF as an example. Since hitting a low of $22.22 on 23 March, the ETF has since risen over 220% to trade at around $72.69 this week and in the year-to-date is up over 125%.

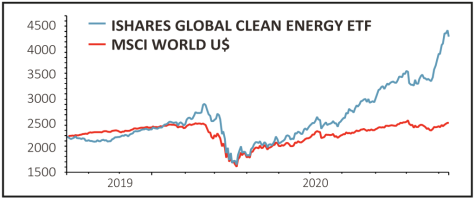

On the London market iShares Global Clean Energy ETF (INRG), which tracks the S&P Global Clean Energy benchmark, has returned 85% year-to-date.

The S&P Global Clean Energy index is comprised of 30 large cap stocks and includes solar PV maker SolarEdge Technology, whose share price has almost trebled so far this year, and wind turbine manufacturer Vestas, which has more than doubled since hitting a low in the March sell-off.

Part of the reason these companies have done so well is the fact that solar and wind farms across the world are now becoming economically viable without government subsidies, a big tailwind for demand for solar panels and wind turbines as the world transitions to renewable energy.

But another big factor in their share price surge has been markets betting on a Joe Biden victory in the US presidential election next month.

If elected Biden says he will take a huge climate and jobs plan to Congress ‘immediately’ after becoming president, with $2 trillion to be spent on clean energy infrastructure and other climate solutions.

Solar and wind stocks have risen markedly in recent weeks in line with data showing Biden to be ahead in the polls. If the Democrats win the Senate and hold onto the House of Representatives, Biden could have a clearer path to push his policies through Congress.

Not all renewable energy funds have enjoyed such a bounce. While still well ahead of the 21% loss from the FTSE 100, VT Gravis Clean Energy Income (BFN4H46) has returned just 16.7% in the year-to-date compared to the 85% from its S&P Global Clean Energy benchmark, along with Pictet Clean Energy (B516829) which has returned 29.4%.

Both funds hold renewable energy power generators, which haven’t fared as well with power prices plunging because of a lockdown-induced lack of demand. A rise in the number of solar and wind farms is good for the solar panel and wind turbine makers, but not so good for the generators which may have to sell their power for less.

DISCLAIMER: Editor Daniel Coatsworth owns shares in iShares Global Clean Energy ETF.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine