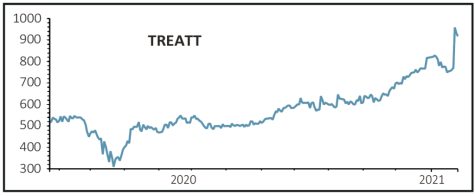

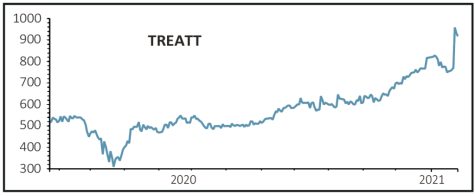

Treatt (TET) 917.52p

Gain to date: 51%

Original entry point: Buy at 607p, 29 October 2020

Shares in extracts-to-ingredients supplier Treatt (TET) have risen by 51% since we said to buy last October. The company says annual profits are expected to ‘materially’ exceed the £15.1 million market consensus and prompted analysts to raise their earnings expectations.

While some investors will be put off by the shares now trading on 37.3 times upgraded earnings forecasts, there is good reason to keep them in your portfolio.

A new UK plant is scheduled to become operational this summer, which will deliver ‘a step change in terms of capacity, capabilities and potential margins,’ says broker Peel Hunt.

‘We see Treatt as on a virtuous circle, where stronger growth is both delivering higher profits and funds to invest in additional capability and capacity.’

Treatt is performing particularly well in its citrus, health and wellness, fruit and vegetables and tea categories and has seen some material new business wins, including in the rapidly growing global alcoholic seltzer category.

As a supplier of natural extracts including its sugar reduction solutions, Treatt is well positioned to profit from the war on obesity post-Covid.

SHARES SAYS: We sense there will be some profit taking by investors in the coming days following the recent spike in the share price, but we see merit in sticking with Treatt longer term as it becomes a stronger business.

‹ Previous2021-01-28Next ›

magazine

magazine