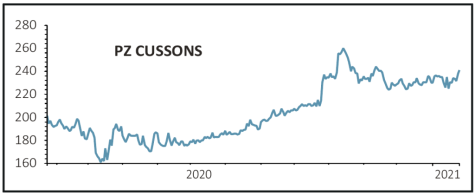

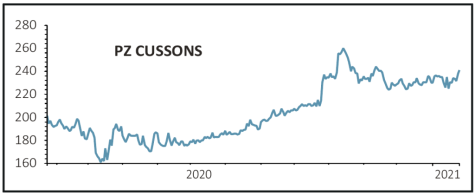

PZ Cussons (PZC) 240.5p

Gain to date: 3.2%

Original entry point: Buy at 233p, 23 December 2020

One of Shares’ key stock selections for 2021, branded consumer goods group PZ Cussons’ shares have edged up 3.2% since we highlighted the company’s turnaround attractions in December.

Encouraging half year results from the Carex hand wash-to-Imperial Leather soap maker suggest recently appointed chief executive Jonathan Myers’ strategy is already starting to bear fruit, with PZ Cussons generating sales and profit growth in all regions during the period.

Total sales grew 10.2% to £312.9 million and adjusted pre-tax profit rose 16.3% to £34.9 million, boosted by pandemic-driven growth in hand wash and hand sanitiser sales in Europe and America as well as an improved performance in Africa, where revenue rose 5.9% and Myers has begun to simplify the key Nigerian business.

PZ Cussons also reported a reduction in net debt, down £120 million to a mere £18 million, giving Myers greater balance sheet flexibility to effect his turnaround, though extra coronavirus-related costs and the uncertain environment meant the dividend was left unchanged at 2.67p.

Myers will share more details of his ongoing strategic review at a capital markets day on 25 March, which could prove to be the next share price catalyst.

SHARES SAYS: PZ Cussons has strong momentum under its new management team. Keep buying.

‹ Previous2021-01-28Next ›

magazine

magazine