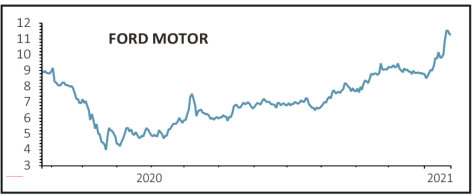

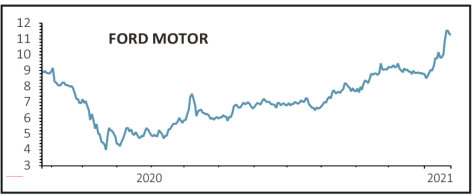

Ford Motor (F:NYSE) $11.29

Gain to date: 61.5%

Original entry point: Buy at $6.99, 13 August 2020

Our decision to flag the value in car manufacturer Ford looks increasingly like a smart move as the shares continue to motor higher.

The company is finally getting some credit for its investments in areas like electric and autonomous vehicles.

One of these investments, electric pickup truck maker Rivian, in which Ford has an undisclosed stake thought to be between 10% and 15%, recently took in a reported additional $2.7 billion in funding. This valued Rivian at $28 billion, roughly the valuation of Ford as a whole when we highlighted its appeal back in August 2020.

Ford is an obvious beneficiary of the vaccine breakthrough in the final quarter of last year as it allowed the market to look through to a reopening of the economy, and with that greater opportunities to sell vehicles.

The Detroit-based firm could also see a tailwind from shifting habits in the wake of the pandemic as people want to use their own vehicles rather than take the perceived greater risks associated with public transport.

A key thing to watch for investors is sales of the Mustang Mach E all-electric SUV which has just started shipping. This will be among the items in focus when the company reports its fourth quarter earnings on 4 February.

SHARES SAYS: Keep buying with upcoming Q4 earnings being the next big catalyst.

‹ Previous2021-01-28Next ›

magazine

magazine