Latin America’s largest economy Brazil has suffered a devastating impact from Covid-19 which has translated into a big financial hit.

While the country’s banks haven’t fared as badly as some feared, with bad debts in particular remaining broadly under control, their valuations have suffered as a proxy for the wider country.

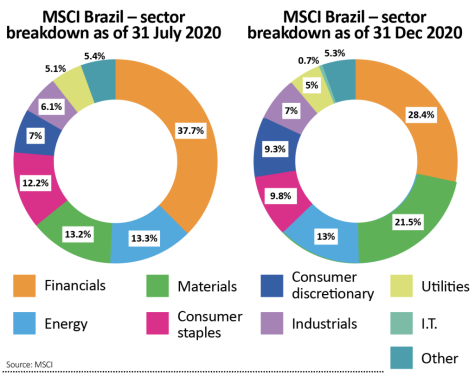

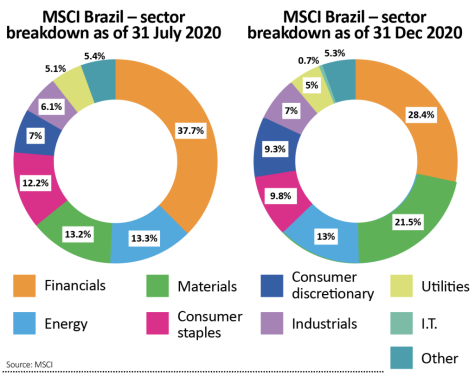

This is evident in the fact that when we last looked at this market in detail in July 2019, financials made up nearly 40% of the MSCI Brazil index – now they account for less than 30%.

Another notable takeaway from the sector breakdown of MSCI Brazil is that technology remains under-represented in the Brazilian market at less than 1% of the index. The broader MSCI Emerging Markets index by contrast has tech as the largest individual sector at a little more than 20%.

A report from the OECD published in October 2020 observed that as of 2018, 23% of Brazil’s adult population had never used the internet. The reported further noted that: ‘More fundamentally, the favourable constellation that fuelled growth until the 2014 recession – an increasing labour force coupled with rising commodity prices – now seems to be exhausted.’

The research added that policies to enhance digital transformation had a ‘key role to play’ in tackling the issues the country faces.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here

‹ Previous2021-01-28Next ›

magazine

magazine