magazine 4 Feb 2021

Download PDF Page flip version

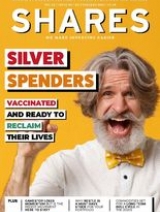

Get ready for the silver spenders. Older people are first to be vaccinated against Covid-19 and Shares believes there is considerable pent-up demand among them to spend on retail and leisure activities. It suggests five stocks to play this theme.

Also in this week’s issue: GameStop shares may have lost momentum but is the Reddit movement here to stay?

Get the latest on the US stocks beating earnings expectations, go under the bonnet of Intel, and discover why Pfizer’s news has put the spotlight on Covid vaccine prices.

You can also read about the outlook for metal prices, the legal sector, Moonpig and the lost decade for Cash ISA savers.

Platinum Equity may want to use Marston’s as an acquisition vehicle to buy up more pubs hurt by Covid-19

A change in CEO didn’t knock the shares off course as Amazon joins the ranks of others to report very strong quarterly numbers

AstraZeneca and Johnson & Johnson say they don’t intend to profit from the pandemic

How long it takes a company to turn sales into cash is vitally important

Opening day gains and punchy price tags demonstrate strong demand for the British boot maker and online greetings cards firm

Its latest results show the shift away from fossil fuels is not going to be easy

Malcolm from Edinburgh has reshaped his pension portfolio after studying some past performance data

The sector offers low valuations, high returns and good growth prospects

The social media network could become much more influential with stocks globally

The two investment trusts are doing a 10-for-1 stock split

We question whether the current widely-held assumptions about markets stack up

Many commodities including silver have been hitting multi-year highs as investors turn optimistic on a range of metals

Five stocks to play pent-up demand for leisure, retail and financial services

The microchip giant is a great value tech recovery play

Stocks and Shares ISAs have massively outperformed cash-based products in the last 10 years

If you fancy making money from the markets, just remember that 100% daily gains are not normal

The frames designer has a built a strong platform for growth in the fragmented global eyewear market

Chip technology firm up 73% but analyst sees €100 upside still

The publisher has a very strong balance sheet and still looks attractively valued

The Johnnie Walker maker has global growth potential and should emerge stronger from the Covid pandemic

Leading global consumer firm is set for long-term growth

The web-based fashion wonder has cherry-picked top brands from fallen retail conglomerate Arcadia

The Reddit-inspired volatility can tell us something about the market's mood

A Shares/AJ Bell podcast listener wants to know how much flexibility they have with managing pension pots