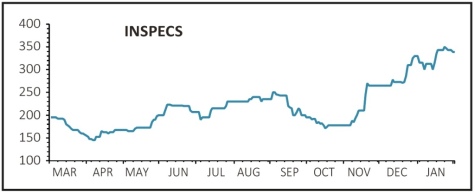

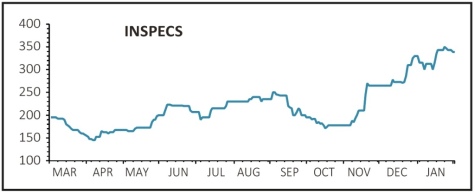

Inspecs (SPEC:AIM) 340p

Gain to date: 25.5%

Original entry point: Buy at 271p, 23 December 2020

Shares in eyewear frames designer-to-optically advanced spectacle lenses maker Inspecs (SPEC:AIM) are up an eye-catching 25.5% since we highlighted the group’s global growth potential and the scale benefits arising from the acquisition of eyewear supplier Eschenbach in December.

An in-line update (29 Jan) for 2020 showed sales coming in at $46.2 million (2019: $61.2 million), a shade ahead of Peel Hunt’s $45 million forecast, and Inspecs also flagged a good start with the integration of Germany-headquartered Eschenbach.

While Covid-related restrictions may hold back Inspecs’ short-term progress, the essential status of opticians means the eyewear industry should remain resilient during the remainder of the pandemic.

‘Inspecs is well placed to make strong progress when restrictions ease and the synergies start to come through, and now has a platform to build a materially larger business,’ says Peel Hunt.

The broker forecasts a sales surge to $241 million in 2021 for adjusted pre-tax profits of $19.5 million, ahead of $256.5 million sales and $24.9 million of taxable profits in 2022. The broker has upgraded its price target from 325p to 365p and reiterated its ‘buy’ rating on the stock.

SHARES SAYS: Keep buying.

‹ Previous2021-02-04Next ›

magazine

magazine