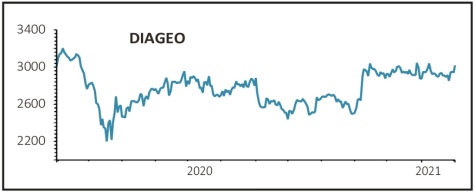

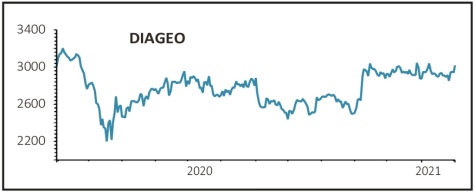

DIAGEO (DGE) £30.04

Gain to date: 2%

Original entry point: Buy at £29.45, 23 December 2020

Our bullish call on high-quality spirits maker Diageo (DGE) is 2% in the money and we are sticking with the business as a compelling reopening trade. Diageo should see a strong recovery in demand in 2021 and beyond as vaccine rollouts enable the global hospitality and travel sectors to recover.

One of Shares’ key selections for 2021, the Johnnie Walker whisky-to-Smirnoff vodka maker returned to organic sales growth during the six months to December 2020. Organic growth of 1% was far better than the decline forecast by analysts, demonstrating the resilience of the spirits leader during a period of pub and bar closures.

Diageo continued to take market share in the retail channel while performance in North America, its biggest market, came in ahead of management’s expectations.

Cash generative Diageo also raised its dividend by 2% to 27.96p, even after operating profits were pressured by pub and bar closures and unfavourable foreign exchange rates.

Diageo did not provide specific guidance for the full year to 30 June 2021 because of the ongoing uncertainty and volatility created by the pandemic, but it expects to see a second half improvement across all regions given weak Covid-impacted comparatives.

SHARES SAYS: Stick with Diageo.

‹ Previous2021-02-04Next ›

magazine

magazine