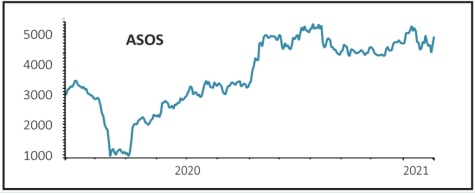

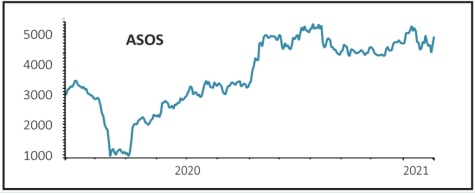

ASOS (ASC:AIM) £47.18

Loss to date: 3.3%

Original entry point: Buy at £48.79, 28 January 2021

Our ‘buy’ call on web-based fashion retailer ASOS (ASC:AIM) is 3.3% in the red, but this reflects wider stock market turbulence rather than anything company specific. In fact, investors applauded the online retailer’s £295 million acquisition (1 Feb) of the Topshop, Topman, Miss Selfridge and HIIT activewear brands from Arcadia’s administrators, names which represent exciting additions to ASOS’s winning online platform.

ASOS is acquiring the brands and intellectual property plus around £30 million of stock, while maintaining selective wholesale relationships such as Nordstrom in the US, though unsurprisingly, the online pure-play is not taking on the stores.

Bringing one-time Arcadia jewel in the crown Topshop in-house, this exciting deal provides ASOS with a significant opportunity to drive the global growth of brands which are highly complementary to ASOS’s existing portfolio and will be slotted into its existing infrastructure.

Pre-Covid, this quartet of brands generated total sales of around £1 billion across all channels, underscoring their potential. Chief executive Nick Beighton expects the deal to deliver a ‘double-digit return on capital’ in the brands’ first full year of ASOS ownership.

SHARES SAYS: The acquisition of Topshop and other Arcadia brands will help structural growth winner ASOS to stand out in the fast fashion crowd. Keep buying.

‹ Previous2021-02-04Next ›

magazine

magazine