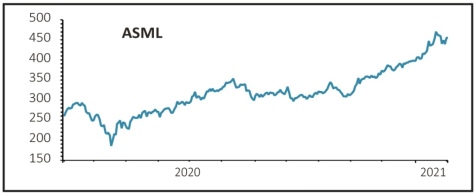

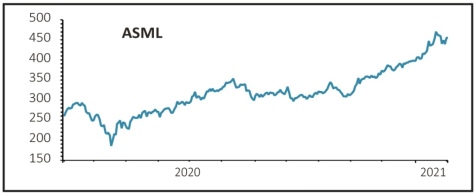

ASML (ASML:AS) €457.40

Gain to date: 72.9%

Original entry point: Buy at €264.60, 23 April 2020

For a company the size of ASML to jump more than 70% in less than a year is impressive, but to do so during a global pandemic is little short of astonishing.

This is one of Europe’s largest listed businesses worth in excess of €184 billion. That would place it 21st if it was listed on the S&P 500, snuggled between Netflix and Intel.

Yet analysts reckon there is more to come, following a bumper end to 2020 and upbeat guidance for this year. ‘ASML’s extremely strong fourth quarter 2020 results and first quarter 2021 guidance reflects the current tightness of semiconductor supply, as well as increased customer confidence in demand for leading edge devices over the longer term,’ says Liberum.

The broker is currently expecting a rough one-third jump in pre-tax profit this year to €5.28 billion on €16.8 billion revenue.

Berenberg analysts admit to seeing some pushback from clients over ASML’s valuation, now on a 2021 price to earnings ratio of 43. But they point to accelerating demand for its EUV technology (extreme ultraviolet lithography) as semiconductor manufacturing clients speed up chip shrinkage roadmaps.

Liberum expects further 2021 forecast upgrades and Berenberg believes the stock could jump another €100 this year.

SHARES SAYS: ASML remains a great long-run value creator.

‹ Previous2021-02-04Next ›

magazine

magazine