Investors looking for a way to play the current strength in oil prices should snap up i3Energy (I3E:AIM). It is buying up conventional oil and gas assets in North America cheaply and plans to pay dividends from the resulting cash flow.

The company’s strategy echoes the one pursued successfully by former AIM peer Diversified Gas & Oil (DGOC), which is now a FTSE 250 company. While Diversified is much larger and focused on the Appalachian region, i3 is active in Canada.

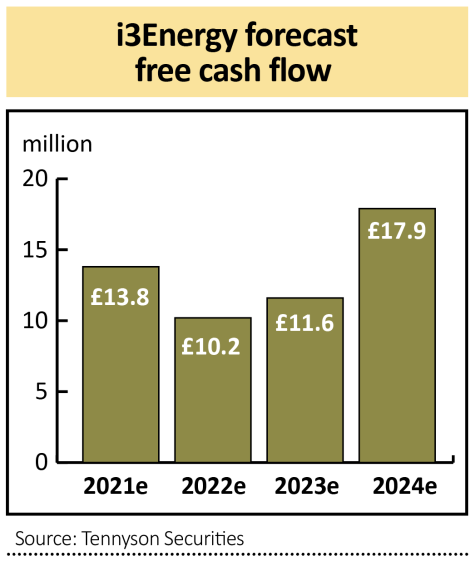

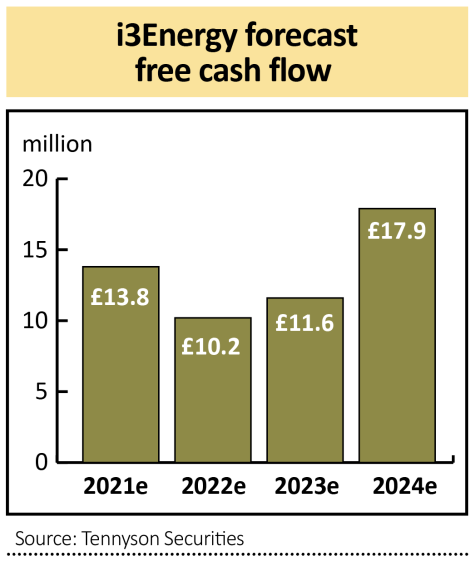

The approach is refreshingly straightforward and i3 plans to pay a special dividend of £1.17 million in late July and dole out a first half dividend in September encompassing up to 30% of that period’s free cash flow.

The company is hedging its production to protect the revenue stream underpinning the dividend. Based on 2022 forecasts from broker Tennyson Securities the shares offer a prospective dividend yield of 5.9%.

The firm began acquiring assets when prices were extremely depressed in the wake of the pandemic in 2020. As a result, these transactions were completed at an average of just one times a year’s worth of net operating income – which CEO Majid Shafiq explains to Shares compares with a more typical level of four times.

Having invested at such low prices the economics on the barrels it produces will be highly attractive and the assets picked up, generating 9,000 barrels of oil equivalent per day of production and encompassing 53 million proven and probable reserves, are so far performing better than expected.

While the cost of transactions is gradually returning to more normal levels, i3 still sees M&A opportunities and it also has the option of investing in drilling to boost output from its existing portfolio having identified hundreds of potential well locations.

This gives it flexibility in the event of future volatility in commodity prices, buying assets cheaply when these markets are depressed and investing for organic growth when prices and therefore the costs of deals are more elevated.

As well as the lower risk Canadian business, the company also has the 100%-operated Serenity oil discovery in the North Sea. It hopes to bring in a partner in the second half of the year to help fund the costs of proving up the find.

‹ Previous2021-07-01Next ›

magazine

magazine