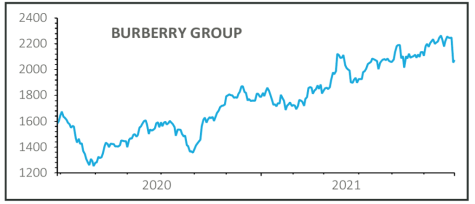

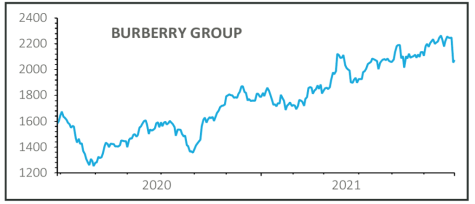

BURBERRY (BRBY) £20.73

Gain to date: 26.9%

Original entry point: Buy at £16.34, 19 Nov 2020

Our bullish call on luxury goods leader Burberry (BRBY) is 26.9% in the money, although the shares were marked down on the disappointing news that Marco Gobbetti plans to step down as chief executive and leave the company at the end of 2021.

Set to return to Italy and take charge of Salvatore Ferragamo, Gobbetti is credited with the positive transformation of Burberry and for taking the brand more upmarket.

His forthcoming departure creates uncertainty, although the appointment of a new broom could act as a positive catalyst and our fundamental thesis remains intact.

Burberry’s shares have recovered from their pandemic-induced slump on the expectation the trenchcoats-to-cashmere scarves seller should prosper as a wealth of unleashed pent-up demand drives a massive boom in luxury goods spending.

Full year results (13 May) confirmed an encouraging sales recovery during the year to March 2021. And in a show of confidence, Burberry reinstated the full year dividend at 2019 levels of 42.5p on the back of strong cash generation, although it also cautioned operating margins will be hit by increased investment and costs normalising in the current financial year.

SHARES SAYS: Gobbetti’s exit comes as a shock, but we still believe Burberry is a buy.

‹ Previous2021-07-01Next ›

magazine

magazine