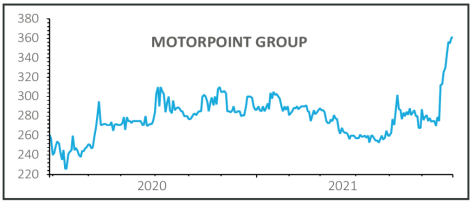

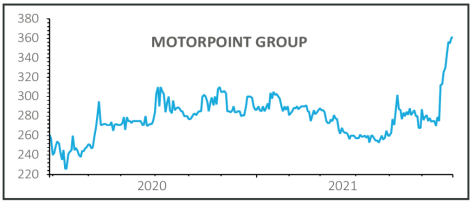

MOTORPOINT (MOTR) 367p

Gain to date: 93.2%

Original entry point: Buy at 190p, 14 May 2020

Shares in used car retailer Motorpoint (MOTR) have increased by 93% in value since we urged readers to hop behind the wheel in May 2020.

The used car seller’s share price recently shot up after management, encouraged by the growth in online sales, outlined exciting new growth ambitions for the group alongside resilient full year results (16 Jun).

These showed better than expected, pandemic-impacted pre-tax profits of £9.7 million (2020: £18.8 million) and Motorpoint also flagged strong trading since its branches reopened.

Motorpoint’s new target is to at least double annual sales to over £2 billion in the medium term, of which more than £1 billion is targeted to be online sales.

This is to be achieved with margins improving and strong cash generation through increased investment in technology, marketing and data, and expansion of the group’s physical presence.

‘The strategy is in effect an acceleration of the existing one, building on the success of the omni-channel proposition that we think is already highly defensible versus online disruptors,’ explained Liberum Capital.

SHARES SAYS: We’re excited by Motorpoint’s accelerated growth strategy. Keep buying.

‹ Previous2021-07-01Next ›

magazine

magazine