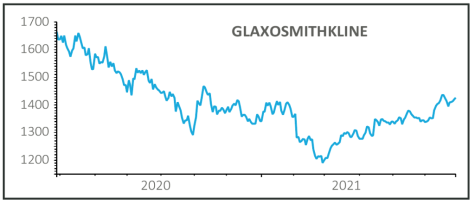

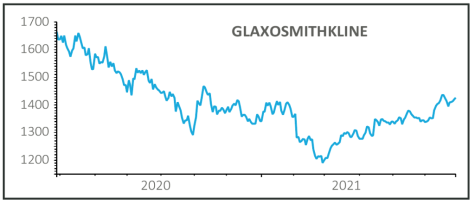

GlaxoSmithKline (GSK) £14.21

Gain to date: 7.6%

Original entry point: £13.21 on 5 November 2020

GlaxoSmithKline (GSK) reassured investors at its latest investor day (23 June) by providing ambitious plans and growth targets for the biopharma business and the planned demerged of its consumer health business.

The company is targeting a compound average growth rate of 5% in revenues and 10% in adjusted operating profits over the next five years to 2026 and hopes to generate at least £33 billion of revenues by 2031.

The current pipeline of approved drugs is expected to get the company 60% of the way to its targets with the rest coming from anticipated approvals over the next five years.

There was some concern that the dividend would halve following the demerger of consumer healthcare next year, but GSK said it would rebase the payout to 55p from 80p this year.

This will comprise a 44p per share dividend from the new biopharma business and 11p from the forthcoming demerged consumer healthcare arm. From 2023 the new GSK dividend is expected to be 45p per share.

GSK will demerge at least 80% of consumer healthcare via a premium listing on the London Stock Exchange, which it said was intended to be tax efficient compared with other ways of separation.

SHARES SAYS: The new targets support our original investment thesis while having an activist investor on the register should keep management on its toes. Stick with the shares.

‹ Previous2021-07-01Next ›

magazine

magazine