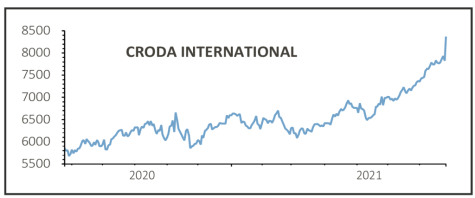

Croda (CRDA) 338.9p

Gain to date: 30%

Original entry point: Buy at £63.84, 1 April 2021

Our confidence in chemicals firm Croda’s (CRDA) new strategy is already being rewarded in spades with its first half results (27 Jul) revealing strong trading and prompting a material upgrade to full year guidance.

Pre-tax profit increased by 41% to £204.1 million, driven by a 39% jump in sales to £934 million. It has proposed to increase the dividend by 43.5p.

There have been several key factors behind the company’s strong showing. The company’s existing operations are benefiting from restocking and a rebound in consumer demand as well as spending on innovation.

A series of recent acquisitions are also contributing nicely, in particular lipid-based drug delivery specialist Avanti. Croda now expects to generate $200 million in sales from lipid systems this year up from the $125 million expected in March. This new-found expertise in lipid nanoparticles was a key reason we liked the Croda story.

Flavour and fragrance firm Iberchem has also made a strong contribution after being acquired in November 2020.

Finally the Life Science division has performed well, driven by its Crop Care and Healthcare arms.

SHARES SAYS: We remain bullish. Keep buying.

‹ Previous2021-07-29Next ›

magazine

magazine