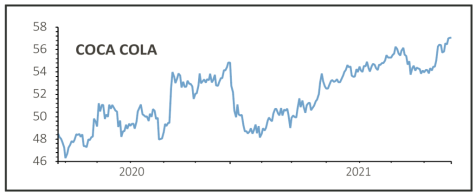

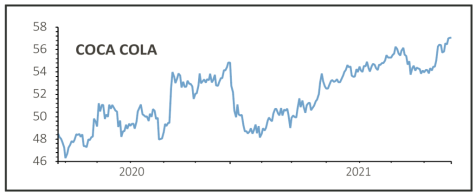

COCA-COLA $57

Gain to date: 17.6%

Original entry point: Buy at $48.48, 30 July 2020

Although comparisons with 2020 were always likely to be fairly easy, Coca-Cola blew away analysts’ forecasts with its second quarter performance, posting its best results for some time.

Net revenues grew 42% to $10.1 billion, almost $1 billion above forecasts and only the second $10 billion-plus quarter in its history, while organic growth was 37% against consensus estimates of less than 30% growth as the company increased its market share to above its pre-pandemic level.

Growth was broad based, with the core Coca-Cola brand registering sales up 12% while Sprite and Fanta registered 18% growth. Nutrition, juice, dairy and plant-based sales jumped 25%, while hydration, sports, tea and coffee sales also saw a 25% increase.

Crucially, developed markets experienced growth alongside developing markets, with case volumes in Europe, Middle East and Africa up 21% and North American volumes up 17%. Also, at-home consumption was strong across all markets with North American sales above 2019.

Earnings per share were well above forecasts and free cash flow was more than $5 billion against $2.3 billion last year.

Full year organic revenue growth now seen between 12% and 14% while earnings are seen up between 13% and 15% compared with high single digits previously on both counts.

SHARES SAYS: Keep buying.

‹ Previous2021-07-29Next ›

magazine

magazine